The dollar edged higher by 0.82% on Friday amid a pullback in US treasury bond yields - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Rupee Outlook and Strategy

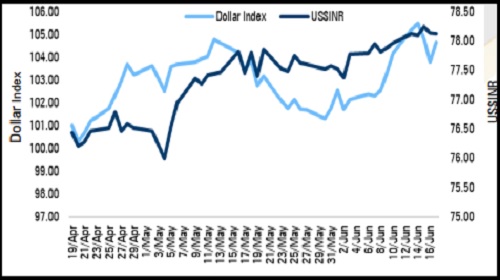

* The dollar edged higher by 0.82% on Friday amid a pullback in US treasury bond yields. However, upsides were restricted by weak US industrial production data. Industrial production in the US rose 0.2% from a month earlier in May against market expectations of 0.4%. It was following an upwardly revised 1.4% growth in April

* US$INR futures maturing on June 28 slipped by 0.03% on Friday amid easing crude oil prices

* The rupee is expected to appreciate today amid weakness in crude oil prices and expectations on fast recovery in Indian economy. In a report, RBI has said India is better placed than many other countries to avoid the risks of potential stagflation with recovery broadly on track. US$INR is expected to break its key support level at 78.00. If US$INR breaks this key support level it is likely to touch 77.75 level.

Dollar Index Vs US$INR

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Above views are of the author and not of the website kindly read disclaimer

Top News

Renaissance Global trading Rs 163.49 crore through preferential allotment of equity shareses...

Tag News

EURINR trading range for the day is 89.13 - 89.49. - Kedia Advisory

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">