The daily price action formed a small bear candle confined within Monday`s trading - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

NSE(Nifty): 14910

Technical Outlook

*The daily price action formed a small bear candle confined within Monday’s trading range (15048-14745), indicating extended breather amid stock specific action.

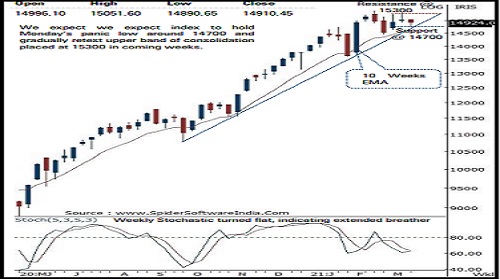

*Going ahead, we reiterate our constructive stance and expect Nifty to gradually retest upper band of consolidation placed at 15300 in coming weeks. In the process, we expect index to hold Monday’s panic low placed around 14700. The rotational sectoral leadership in IT and FMCG signifies inherent strength. Therefore, any dip from here on should be capitalized as incremental buying opportunity in quality large caps and midcaps stock.

*Key point to highlight since September 2020 is that, on multiple occasions index has respected the key support of upward slopping trend line (as shown in chart) coincided with 50 days EMA and subsequently paved the way for next leg of up move. In current scenario as well Nifty bounced from the aforementioned strong support zone placed around 14700, highlighting inherent strength

*The developed markets are trading at their life highs, indicating acceleration of upward momentum. We expect, positive correlation to play out in the domestic market as well in coming weeks.

*The broader market indices are undergoing healthy retracement after recent outperformance, as over past seven sessions Nifty midcap and small cap indices have retraced 50% to 61.8% of preceding four sessions up move. Slower pace of retracement signifies robust price structure that augurs well for subsequent up move. Thus we expect, broader markets to accelerate relative outperformance in coming weeks

*Structurally, we do not expect index to breach the key support threshold of 14700 as it is confluence of:

*a) The 80% retracement of past two weeks up move (14468- 15336), at 14642

*b) Past tow week’s low is placed at 14639

*In the coming session, follow through strength above past two session’s identical high (spot-15052) would confirm conclusion of corrective bias and resume primary up trend. Else, extended consolidation amid stock specific action. Hence, use intraday dip towards 14905-14932 to create long position for target of 15019

NSE Nifty Daily Candlestick Chart

Nifty Bank: 34804

Technical Outlook

*The daily price action formed a bear candle which remain enclosed inside previous session high -low range signalling consolidation and lack of follow through to Monday’s second half strong pullback .

*Going ahead, we expect the index to hold above the major support area of 34000 -34500 and extend the current healthy consolidation in the broad range of 34000 -36500 in the coming sessions

*The index on Monday’s session rebounded from the major support area of 34500 -34000 levels being the confluence of the following technical observations :

a) The 38 . 2 % retracement of the budget rally (29687 -37708 ) placed at 34645 levels

b) The rising 50 days EMA placed at 34110 levels

c) the rising trendline support joining lows since September 2020 is also placed around 34300 levels

*The index over the past 20 sessions has retraced just 38 . 2 % of preceding 13 sessions sharp up move (29688 -37708), at 34645 . The slower pace of retracement signifies healthy retracement and a higher base formation for the next leg of up move . Therefore, the current breather should not be seen as negative and should be capitalised on as incremental buying opportunity

*In the coming session, the index is likely to open on a flat to positive note on back of firm global cues . Volatility is expected to remain high on account of the volatile global cues . We expect the index to hold above Monday’s panic low (34455 ) . Hence use dips towards 34720 -34780 for creating intraday long position for the target of 34990 , maintain a stoploss at 34610

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

Stock Picks : TCS Ltd And Chambal Fertiliser Ltd By ICICI Direct