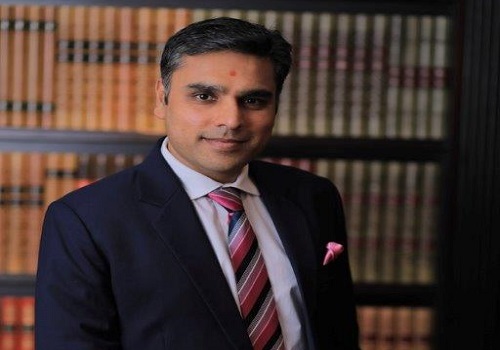

The current stance on the repo rate will have lower impact on the mortgage rate Says Nitin Bavisi, Ajmera Realty and Infra India Ltd

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Perspective on RBI MPC Policy Announcement by Nitin Bavisi, CFO, Ajmera Realty and Infra India Ltd.

“The RBI's decision to hike the repo rate by 35 bps is on the much-expected lines with the primary goal of keeping inflation in check. Although this will lead to a marginal rise in lending rates, it may not be of much deterrence for the real estate industry backed by the positive sentiments of homebuyers and strong demand influenced due to the price rise of Indian real estate in the days to come. The current stance on the repo rate will have lower impact on the mortgage rate, as the pace of hike has been moderated and hence perceived positively by the home buyer.

Inflation has been moderating as RBI has been keenly focused on the evolving changes and taking real-time corrective action in the best interest of economic growth as it continues to float above 4 per cent in the next 12 months. With the growth forecast positioned at 6.8% and manufacturing services PMI for India in November amongst the highest in the world, we are hopeful of a positive turnout.”

Above views are of the author and not of the website kindly read disclaimer

More News

Quote On Monetary Policy by Gurvinder Singh Wasan, JM Financial Asset Management

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">