The US dollar remained elevated near its 2020 highs - ICICI Direct

INR Pairs

* The rupee depreciated by another 6 paise in the last session as pressure on domestic equities continued. Globally also, Dollar index maintained its strength and hovered around 92.60 levels also extending pressure

* The pound dropped to the lowest since early February as a vaccine row between the UK and the EU rumbled on amid doubts about the country’s economic outlook

Global Bonds

* The Nifty remained under pressure and moved below its major Put base of 14500 in the opening itself. Despite late recovery in the banking space, weakness in the auto and FMCG space forced the index to end near the lowest levels

* The Bank Nifty closed the March series with losses of more than 5% with weakness continuing on the settlement day as well. Despite a late recovery in private sector heavyweights, the banking index lost almost 1% in the session

FII & FPI Activities

* Foreign institutional investors (FII) remained net buyer to the tune of | 405 crore on March 24. They sold worth | 1610 crore in the equity market and bought worth | 2015 crore in the debt market

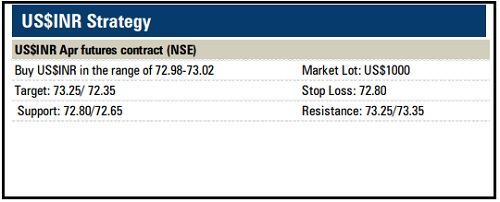

US$INR futures on NSE

* The US dollar remained elevated near its 2020 highs. Weakness seen in GBP and Euro due to fresh concerns over the economy also helped the dollar to remain stable at higher levels

* The dollar-rupee April contract on the NSE was at | 73.08 in the last session. The open interest increased by almost 16% for the April series

US$INR Strategy

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer