Sell JPYINR Mar @ 59.5 SL 59.7 TGT 59.2-59 - Kedia Advisory

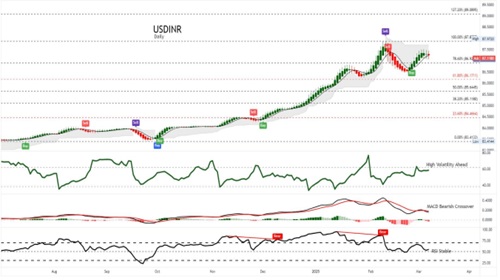

USDINR

BUY USDINR MAR @ 87.4 SL 87.25 TGT 87.55-87.65.

Observations

USDINR trading range for the day is 87.05-87.69.

Rupee dropped amid persistent outflows from local stocks, ongoing economic uncertainty and trade tariff concerns.

RBI said that it will infuse $21 billion in Rupee liquidity into the banking system.

Fed’s Chair Powell warning that policy uncertainty makes it difficult for the US central bank to enact policy adjustments.

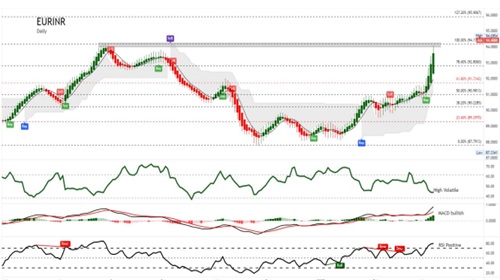

EURINR

SELL EURINR MAR @ 95 SL 95.25 TGT 94.75-94.5.

Observations

EURINR trading range for the day is 94.19-95.45.

Euro gains as risk appetite improved, while investors continued to navigate global economic and trade uncertainties.

Germany's trade surplus fell to EUR 16 billion in January 2025 from EUR 20.7 billion in December 2024

Industrial production in Germany increased 2% month-over-month in January 2025, rebounding from a 1.5% decline in December 2024

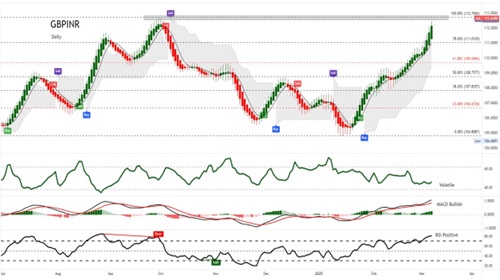

GBPINR

SELL GBPINR MAR @ 113 SL 113.3 TGT 112.7-112.5.

Observations

GBPINR trading range for the day is 112.33-113.27.

GBP rose driven by a weaker US dollar amid concerns about the US economy and the impact of upcoming tariffs.

GBP also benefited from expectations that UK interest rates will stay higher for longer.

BoE’s Ramsden warned that persistent wage pressures could keep inflation elevated but suggested future rate cuts could accelerate if needed

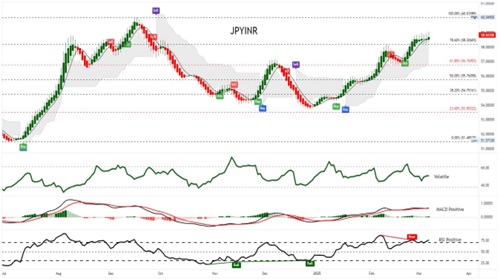

JPYINR

SELL JPYINR MAR @ 59.5 SL 59.7 TGT 59.2-59.

Observations

JPYINR trading range for the day is 59.23-59.59.

JPY strengthened amid escalating concerns over a global trade war and a potential US economic slowdown fueled.

Japan's current account turned to a deficit of JPY 256.6 billion in January 2025

Japan's loan growth accelerated in February 2025, with the total value of loans rising 3.1% year-on-year