The US dollar rallied yesterday due to risk aversion in the global markets - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Rupee Outlook and Strategy

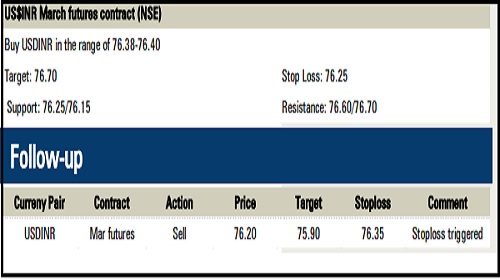

The US dollar rallied yesterday due to risk aversion in the global markets and hawkish statements from Fed officials. San Francisco Fed President Mary Daly and Cleveland Fed President Loretta Mester indicated a bigger hike in central bank’s next meeting. Surge in crude oil prices, worries over stagflation rattled investors

Rupee future maturing on March 29 depreciated by 0.20% amid strong dollar and surge in crude oil prices. Rising oil prices renewed worries about inflation

The rupee is expected to depreciate today amid strong dollar and risk aversion in global markets. Further, the rupee may slip on persistent FII outflows and surge in crude oil prices. Investors are worried that rising commodity prices will add additional upward pressure on already high inflation due to supply chain bottlenecks. Further, market participants will remain vigilant ahead of manufacturing PMI data from the US,UK and Europe

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Above views are of the author and not of the website kindly read disclaimer

Tag News

EURINR trading range for the day is 89.13 - 89.49. - Kedia Advisory

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">