The Nifty tried to sustain above 16300 level - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Daily Snapshot

* The rupee snapped its five day winning streak on Monday, closing 11 paise lower at 74.26 on the back of recovery in US dollar index

* The dollar steadied in early trading on Tuesday, trading near its four month highs of 93 levels following Friday’s strong nonfarm payrolls release as investor priced in an early tightening of monetary policy by the US Federal Reserve

* The Nifty tried to sustain above 16300 level but failed as it faced selling pressure at higher levels and closed almost flat. Looking at option data, 16000 and 16200 Put option holds substantial OI, which should act as immediate support zone and cap downside.

* On Monday, the Bank Nifty outperformed Nifty as it closed with a gain of more than 0.52%.

* Foreign institutional investors (FII) turned net buyer to the tune of | 202 crore on August 6. They bought worth | 157 crore in the equity market and bought worth | 45 crore in the debt market Outperformance in Bank Nifty was led by private sector banks.

Rupee Outlook and Strategy

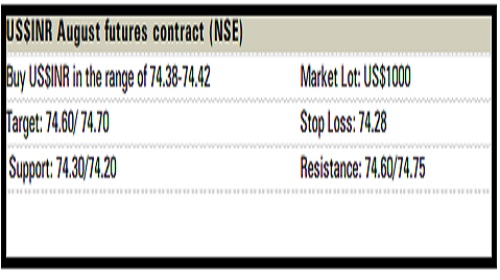

* On the options front, the US$INR has significant open interest at 74.25 Put strike. It suggests that US$INR is likely to consolidate above 74.25 levels. However, positive domestic equities and easing oil prices will limit the depreciation of rupee

* The dollar-rupee August contract on the NSE was at | 74.42 in the last session. The open interest rose almost 2% for the August series

US$INR Strategy

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

EURINR trading range for the day is 89.13 - 89.49. - Kedia Advisory

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">