The Nifty started the session around 14950 mark - Angel Broking

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Sensex (49802) / Nifty (14721)

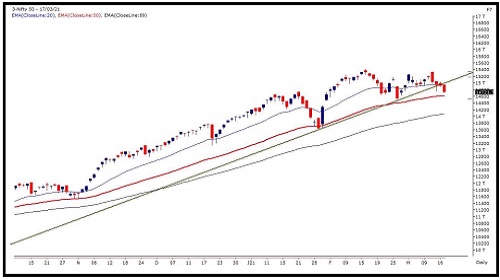

The Nifty started the session around 14950 mark. Post some correction in the first hour of trade, it witnessed a pullback towards the opening level. However, the bounce got sold into and the index then corrected till the end of the session to post a loss of about 200 points and end tad above 14700 mark. The corrective phase continues for our markets and post some consolidation, the broader markets too were seen under pressure ahead of the U.S. Fed Policy.

The last hour correction in the banking index resulted into further pressure and lack of buying interest is now clearly resulting into a price wise correction as well. Nifty has ended around 14700 which is a crucial point now and a breach of this could then lead to a continuation of price wise correction towards 14500. On the flipside, 14850 - 14900 becomes the immediate hurdle now.

The Banking index has undergone a consolidation phase in last one month and the index has breached below its support. On the other hand, the Nifty midcap index too ended below its ‘20 DEMA’ indicating profit booking in this space after a stupendous rally. Amongst other indices, Auto index too is indicting signs of weakness and looking at the above scenarios, we continue with our advice to avoid aggressive trades and look for stock specific trading opportunities.

Nifty Daily Chart

Nifty Bank Outlook - (34229)

Yesterday the banking index had a flat to positive start in line with the benchmark. However similar to previous sessions, it failed to sustain at higher levels. In fact the selling augmented as the day progressed and eventually due to last hour extended sell off, the BANKNIFTY ended the session with slightly less than a couple of percent cut.

The banking space has been the weakest link and day before yesterday, we witnessed banks dragging the market lower. Due to follow through correction in some of the heavyweights banking counters, the index has finally slipped below 34500 on a closing basis. This certainly does not bode well for the bulls and hence, any bounce back from hereon towards 34500-35000 should be used to lighten up longs. On the flipside, further weakness could drag the BANKNIFTY towards 33900 - 33500 levels.

Nifty Bank Daily Chart

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://trade.angelbroking.com/Downloads/ARQ-Disclaimer-Note.pdf

SEBI Registration number is INH000000164

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

On the higher side, immediate resistance is seen around 36000 - 36200 levels - Angel One

More News

Index is likely to open on a flattish note today and is likely to remain range bound during ...