The Nifty scaled a fresh all-time high of 15340 and settled Monday`s session - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

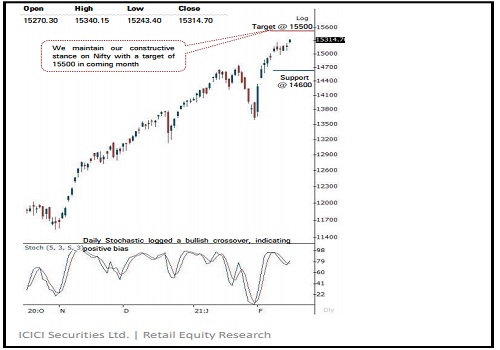

NSE (Nifty): 15315

Technical Outlook

* Equity benchmarks started the week on a buoyant note tracking positive global cues. The Nifty scaled a fresh all-time high of 15340 and settled Monday’s session at 15315, up 151 points or 1%. The market breadth slightly turned in favour of declines with A/D ratio of 1:1.3. Sectorally, financials outperformed while metal, IT and pharma taking a breather.

* The index witnessed follow through strength as it resolved out of last week’s trading range and closed near fresh all-time high of 15340. As a result, the index formed a bull candle carrying higher high-low, indicating continuance of positive bias

* Going ahead, we reiterate our constructive stance on the Nifty and expect it to head towards our earmarked target of 15500 in the coming weeks as it is 161.8% external retracement of last fall (14754-13596), at 15466

* Key point to highlight is that the Bank Nifty has reordered a flag breakout, indicating acceleration of prevailing uptrend. This augurs well for extension of ongoing rally toward 15500 in Nifty, as Bank Nifty components carry 35% weightage in Nifty. In the process, stock specific action would continue as we approach the fag end of the Q3FY21 earning season

* On expected lines, broader market relative outperformance endured as Nifty midcap index extended gains and recorded fresh all time high. Hence, it maintained its strong positive correlation with developed market peers as small cap indices of developed peers have been resilient with US index hitting fresh life-time high. We expect small cap indices to witness catch up activity from here on as they are still 18% away from life-time highs

* Structurally, the formation of higher peak and trough on the larger degree chart signifies robust price structure, which makes us confident of revising support base upward at 14900 as it is confluence of 50% retracement of post budget rally (14470-15340), placed at 14905 coincided with last week’s low of 14977

* The Dollar index has been facing stiff resistance from downward sloping trend line and is currently hovering around multi year breakdown area of 90.

* The prolonging of weakness in Dollar index would be key monitorable, which will act as tailwind for emerging markets and provide impetus to domestic bourses In the coming session, we expect the index to witness follow through strength to recent consolidation breakout (15257-14977). Hence, use intraday dips towards 15290-15315 to create long position for the target of 15398

NSE Nifty Daily Candlestick Chart

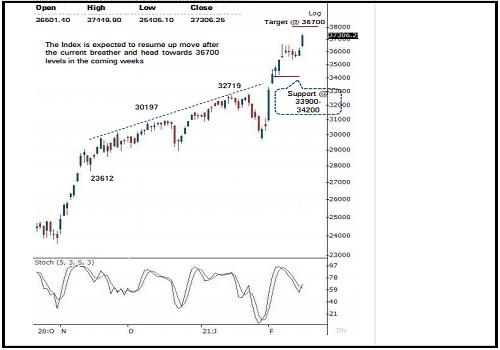

Bank Nifty: 37306

Technical Outlook

* The Nifty Bank started the week on a buoyant note to settle above 37000 mark for first time ever . Private banks led gains (up 3 . 6 % ) whereas Nifty PSU bank index gained 2 . 6 % . BankNifty index closed 3 . 6 % or >1300 points up at 37306

* The price action resulted in a strong bull candle which resolved above past five sessions narrow trading range (35400-36600) indicating rejuvenated momentum and continuation of positive bias .

* Going forward, we expect BankNifty to extend its ongoing rally and head towards 37800 , which is implication of five day range breakout (1200 points) projected from breakout level of 36600 levels

* Structurally, th e rising peak and trough formation after faster retracement of pre budget correction signifies robust price structure from medium term perspective .

* On relative terms private banking space is favourably placed and expected to outperform within BFSI space

* The key short term support for the index is placed around 35400 levels as it is the confluence of the following : a) 38 . 2 % retracement the current up move 29687 to 37449 is placed around 35618 levels b) Last week’s low placed at 35428 levels In the coming session, the index is likely to open on a flat note amid firm global cues .

* We expect index to maintain a higher high -low formation, indicating continuance of positive bias . Hence , after a soft opening we recommend to utilize intra day dips towards 37265 -37315 for creating fresh long positions in Bank Nifty February Futures for target of 37450 meanwhile stop loss is placed at 37205

Bank Nifty Index – Daily Candlestick Chart

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

.jpg)

Tag News

Stock Picks : TCS Ltd And Chambal Fertiliser Ltd By ICICI Direct

More News

Nifty opened with an upward gap and witnessed selling for most part of the session - Jainam...