The Nifty opened the derivative expiry session with a positive gap (14982-15080) and traded above - icici direct

Technical Outlook

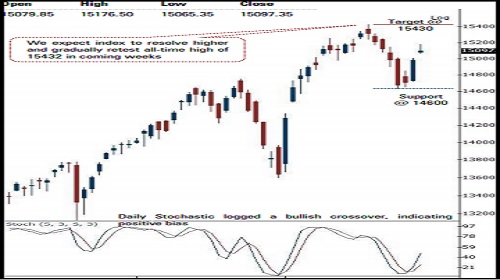

* The Nifty opened the derivative expiry session with a positive gap (14982-15080) and traded above the same throughout the session, indicating inherent strength. As a result, index formed a bull candle carrying higher high-low, indicating continuation of positive bias. Over past two sessions index has retraced 61% of preceding six sessions decline (15432-14635), signifying rejuvenation of upward momentum. In the process, Nifty midcap index clocked a fresh all time high, signifying relative outperformance

* The profit booking seen across global equity due to rise in bond yields. Going ahead, bond yields will be key monitorable, as that would lead to rise in volatility. Therefore, we believe, Nifty sustaining above the psychological mark of 15000 (on a closing basis) would keep positive momentum intact, else extended breather amid stock specific action. However, we do not expect index to breach key support threshold of 14600, hence dips should be capitalised to accumulate quality large cap stocks as we expect Nifty to gradually retest all-time high of 15432 in coming weeks.

* Key point to highlight is that, broader market continued to outshine the benchmark as, both Nifty midcap and small cap indices surpassed their last week’s high, showcasing broader market resilience. In the process, Midcap index scaled to a fresh all time high. Going ahead, we expect broader market to endure its relative outperformance, wherein catch up activity would be seen in small caps, as it is still 16% away from its life-time highs.

* Structurally, the formation of higher peak and trough signifies robust price structure. We believe, the recent healthy retracement has helped index to form a higher base around 14600 and paved the way for the next leg of up move. Therefore, any decline toward 14600 should be capitalised on as incremental buying opportunity in coming weeks as it is :

* a) 50% retracement of post Budget rally (13662-15432), at 14550

* b) Monday’s panic low is placed at 14635 In the coming session, Nifty future is likely to witness gap down opening tracking weak global cues. However, we expect, index to attempt a pullback post gap down opening. Hence, use intraday dip towards 14870-14905 to create long position for target of 14993

NSE Nifty Daily Candlestick Chart

Bank Nifty: 35257

Technical Outlook

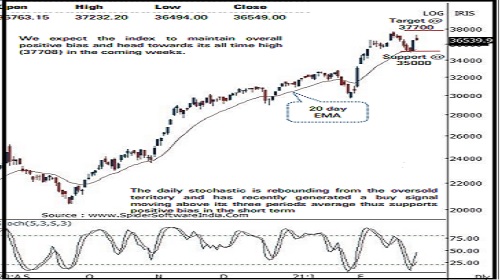

* The daily price action formed a small bear candle which maintained higher high -low signalling a breather after last sessions strong up move . The index in today’s session is opening gap down on back of weak Global cues . Hence some consolidation after Wednesday sharp up move is likely in the coming sessions

* Goining ahead, we believe the overall bias remain positive and the current dip provides buying opportunity for up move towards the all time high (37708 ) in the coming weeks .

* Key point to highlight is that the recent 7 % corrective decline in Bank Nifty is lesser in magnitude compared to the previous 10 % decline of January 2021 . A smaller degree of correction and larger magnitude of rallies clearly highlights the robust price structure in the index

* The index has immediate support at 35000 levels as it is the confluence of the following observations : a) The current week low is placed at 34976 levels b) The rising 20 days EMA is also placed at 35150 levels c) 38 . 2 % retracement of the post budget rally (30906 to 37708 ) is placed around 35110 levels

* In the coming session, the index is likely to open on a negative note on the back of weak global cues . volatility would remain high owing to volatile global cues . We expect the index to trade in a range and attempt a pullback . Hence after a negative opening use dips towards 35920 -35980 for creating intraday long position for the target of 36180 , maintain a stoploss at 35820 Among the oscillator the daily stochastic is in up trend and is seen rebounding from the oversold territory . It has recently generated a buy signal moving above its three periods average thus supports the positive bias in the index

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

More News

Quote on Morning Market Views from Dr. VK Vijayakumar, Chief Investment Strategist, Geojit I...