The Nifty opened on a tepid note on the back of weak global clues - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

INR Pairs

* After depreciating sharply in the past few sessions, some breather was seen for the rupee as it appreciated almost 28 paise. In the last trading session, the rupee ended near 73.1 levels

* The dollar retraced from its four month high and posted marginal losses. Strength in stocks on Wednesday curbed liquidity demand for the dollar. The dollar saw underlying support from higher T-note yields and President Biden’s announcement of his $2.25 trillion infrastructure plan

Global Bonds

* The Nifty opened on a tepid note on the back of weak global clues. It witnessed a volatile day but managed to close in the green. Advance/decline ratio was in favour of Bulls

* The Bank Nifty opened lower but rebounded from lower levels and closed with healthy gains. Buying was seen in private heavyweights, which helped the index to rebound from lower levels

FII & FPI Activities

* Foreign institutional investors (FII) turned net buyers to the tune of | 774 crore on March 31. They bought worth | 774 crore in the equity market and sold worth | 31 crore in the debt market

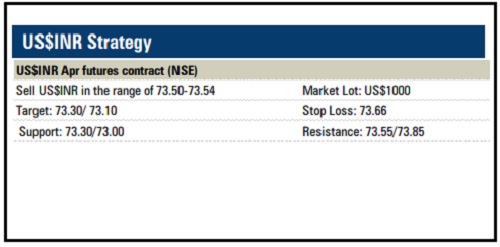

US$INR futures on NSE

* As the Dollar index has retraced from fresh four-month’s high with Call writing positions intact in OTM strikes. We feel a marginal retracement towards 73 levels could be possible in the US$INR pair

* The dollar-rupee April contract on the NSE was at | 73.42 in the last session. The open interest remained almost flat for the April series

US$INR Strategy

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Above views are of the author and not of the website kindly read disclaimer

Tag News

EURINR trading range for the day is 89.13 - 89.49. - Kedia Advisory

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">