The Nifty May rollover stands at 66.01% on Wednesday compared to 65.14% on same day of previous expiry - Axis Securities

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

NIFTY HIGHLIGHTS

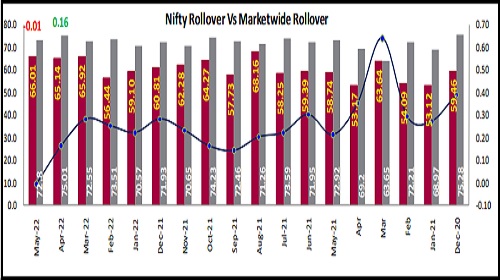

The Nifty May rollover stands at 66.01% on Wednesday compared to 65.14% on same day of previous expiry. The Market wide May rollover stands at 72.8% on Wednesday as compared to 75.01% on same day of previous expiry. The rollover cost in the May series stands at -0.01 on Wednesday compared to 0.16 on same day of previous expiry. The Nifty May rollover is higher than its Three months average of 62.5% and higher than its six months average of 61.62% as on today. The market wide rollover is higher than its three months average of 73.69% and higher than its six months average of 72.37%. Bank Nifty May rollover stands at 60.36% on Wednesday compared to 66.22% on the same day of previous expiry which is lower than its Three months average of 68.12% and lower than its six months average of 62.81%. The Option data of MAY series shows high Call OI at 16,100 strike price followed by 16,300 & 16,200 and high Put OI concentration is seen at 16,000 followed by 15,800 & 15,900 indicating the probable range for current expiry.

Nifty Rollover Vs Market wide Rollover

To Read Complete Report & Disclaimer Click Here

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

More News

Bullish above 36846 (200 Day SMA) NIFTY takes support at 20 Day SMA (17430) - GEPL Capital