The Bank Nifty witnessed sharp decline and closed lower by almost 3 % on Wednesday - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

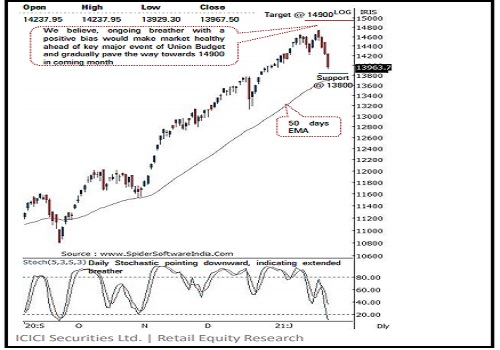

NSE (Nifty): 13968

Technical Outlook

* Equity benchmarks extended corrective phase over fourth consecutive session and settled below the psychological mark of 14000. The Nifty ended Wednesday’s session at 13968, down 271 points or 1.9%. Market breadth remained weak with A/D ratio of 1:2. Barring FMCG, all other indices ended in red weighed by financials, metal, auto and pharma

* The daily price action formed a sizable bear candle carrying lower high-low formation, indicating prolonged correction as selling pressure accelerated on the breach of 14100 mark.

* Key point to highlight since March 2020 is that, intermediate decline has not lasted for more than a week with average correction is in the tune of 8-10%. In current scenario, as the index has already corrected over past four consecutive sessions which has lead the daily stochastic oscillator at an oversold territory with a reading of 10. The index is also approaching major support area of 13800, which we expect it to hold.

* Hence, we believe, ongoing breather has helped the index to work off the overbought condition and is seen as a healthy correction ahead of key major event of Union Budget, and consequently pave the way for next leg of rally towards 14900 in coming months. Meanwhile, 14500 would act as immediate resistance. The stock specific activity would prevail as we proceed the Q3FY21 earning season. Our target of 14900 is based on:

* a) 138.2% extension of May-September rally (8806-11794), projected from September low of 10790, placed at 14919

* b) long term resistance trend line, drawn adjoining November 2010 March 2015 highs of 6334-9119, placed around 15000

* We expect broader market to endure its relative outperformance post Union budget. Currently Nifty midcap and small cap indices are undergoing slower pace of retracement as over past two weeks both indices have merely retraced 38% of preceding three weeks rally, indicating healthy consolidation. The Nifty midcap index has been consolidating after clocking new life-time highs, whereas small cap index is still ~30% away from all time high. Thus, we expect small caps to witness catch up activity

* Structurally, we expect ongoing corrective phase to find its feet around 13800 as it is confluence of 61.8% retracement of current up move (13131-14754) at 13751 coincided with January low of 13954

* In the coming session, volatility would remain high owing to monthly derivative expiry. Index after the recent breather is approaching the major support area around 13800 and the daily stochastic oscillators are also at oversold territory. Hence use intraday dips towards 13825- 13852 for long position for the target of 13939

NSE Nifty Daily Candlestick Chart

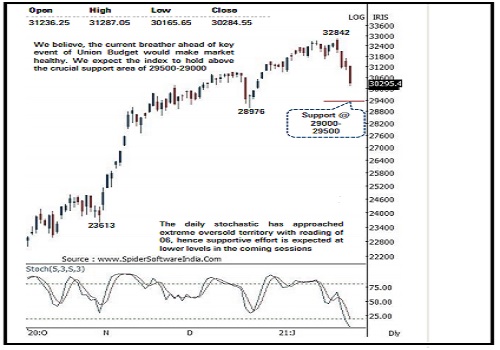

Bank Nifty: 30284

Technical Outlook

* The Bank Nifty witnessed sharp decline and closed lower by almost 3 % on Wednesday on back of weak global cues . All the 12 index constituents closed in the red . The decline was lead by the private banking stocks as the nifty private bank index closed lower by more than 3 % . Nifty bank index ended the session at 30284 , down by 913 points or 2 . 9 %

* The daily price action formed a sizable bear candle with a lower high -low signals continuation of the corrective bias . The index contrary to our expectations has breached the immediate support area of 30800 indicating extension of the decline .

* We believe, ongoing breather after recent rally would make market healthy ahead of key event of Union Budget and provides fresh entry opportunity

* Going ahead, we expect the index to hold the crucial support zone of 29500 -29000 . Hence, investors should not construct the current profit booking as negative, rather utilize the same as an incremental buying opportunity to accumulate quality banking stocks

* The index has crucial support at 29500 -29000 levels being the confluence of the following technical observations : a) 38 . 2 % retracement of the previous major up move 24120 to 32842 placed at 29400 levels b) the previous major tough of December 2020 is also placed around 29000 levels

* In the coming session, the index is likely to open on a negative note on the back of weak global cues .

* However after the recent sharp decline the stochastic oscillator has approached extreme oversold territory hence a pullback is expected . Hence, use intraday dips towards 29980 -30040 in Bank Nifty January future for long position for target of 31240 , maintain a stoploss of 29870

Bank Nifty Index – Daily Candlestick Chart

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Top News

Generic drug prescription mandate unlikely to impact profitability of Indian pharma companie...

Tag News

Stock Picks : TCS Ltd And Chambal Fertiliser Ltd By ICICI Direct

More News

Nifty is suggesting a gap up opening where 15775 will act as an immediate resistance; above ...