The Bank Nifty remained under pressure as it underperformed the Nifty and closed with a loss of more than 0.60% - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Daily Snapshot

The rupee extended losses for a third straight session on Wednesday and fell by 1 paise to end at 74.42 amid weakness in most Asian currencies

The dollar held near a four month peak against major currencies on Thursday after retreating overnight as a cooling in consumer inflation tampered bets for an earlier tightening of US monetary policy

The Nifty witnessed a volatile day where it rebounded after taking support from 16200 Put writers. Looking at option data, 16300 Call option witnessed significant OI addition, which should act as resistance. On the other hand, 16200 Put option holds noteworthy OI, which should act as support

The Bank Nifty remained under pressure as it underperformed the Nifty and closed with a loss of more than 0.60%

Foreign institutional investors (FII) turned net seller to the tune of | 405 crore on August 10. They seller worth | 80 crore in the equity market and sold worth | 325 crore in the debt market

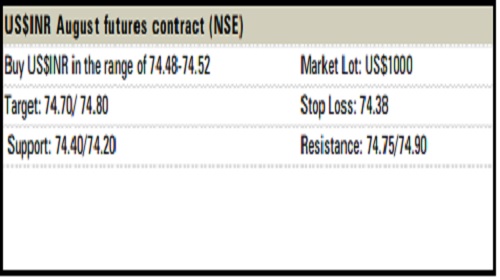

Rupee Outlook and Strategy

The rupee is expected to maintain its trading range between the level of 74.40 and 74.60 as aggressive additions were seen in ATM 74.50 Call, Put strikes of US$INR, which indicates consolidation around these levels

The dollar-rupee August contract on the NSE was at | 74.54 in the last session. The open interest rose almost 0.53% for the August series

US$INR Strategy

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

EURINR trading range for the day is 89.13 - 89.49. - Kedia Advisory

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">