TejiMandi to revolutionize equity investment for retail investors with equity investment advisory

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Mumbai, 15 February 2021:TejiMandi (TM Investment Technologies Pvt. Ltd.) is a SEBI- registered investment advisor which simplifies stock market investing for retail investors. A subsidiary of Motilal Oswal Financial Services, TejiMandi aspires to provide prowess of equity investment services at a low-cost accessible price point. The investment team is led by Chief Investment Officer Vaibhav Agrawal and includes industry veterans Mr. Raamdeo Agrawal & Mr. Ajay Menon on the board of directors.

With an objective to become one of the most accessible & actively managed investment advisory services in India for retail investors, TejiMandi offers an all-weather model actively managed investment with regular rebalance updates through its application. This is a broker agnostic facility, where users can transact using their existing demat account or get assistance in opening a new one.

Subscription plans to the application start at Rs. 149/month and provide investors access to an actively managed investment advisory with portfolio of 15-20 stocks at a one click buy, sell & rebalance facility. The stocks are recommended based on the investor’s risk profile. The investment strategy combines tactical bets with long-term winners. Tactical bets include special company situations from a 3-6 month perspective, while long-term winners looks at stocks from a 12-18 month perspective. The team is disciplined with rebalancing and looks at three scenarios – 1) A change in fundamentals 2) Too much noise around a stock 3) A company with a substantially better risk-reward ratio. The team also advises investors to park their money in liquid instruments like index funds and ETFs when the market crashes or is extremely volatile to help them in mitigating risk.

What sets the product apart is its focus on providing the rationale behind why the customer should buy/sell stocks along with a non-discretionary advisory model, where the customer has the power to execute and have pragmatic control on their investments, unlike mutual fund investments. With a minimum investment advice starts at as low as Rs 20,000, the product makes equity advisory significantly more accessible compared to PMS products where the minimum ticket size is Rs. 50 lacs.

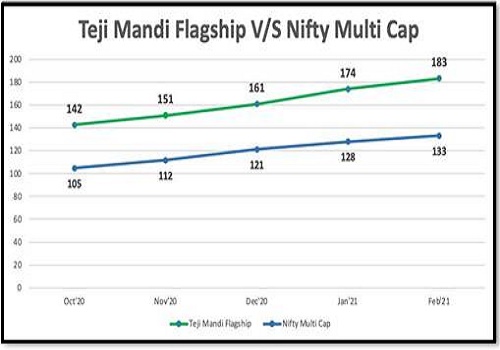

The company’s flagship portfolio has generated a stellar return of 82% since its inception in February 2020. Graph is as given below.

“With strong and myriad noises surrounding you on buying stocks, making a prudent investment call has become a complicated affair. For individuals who are first time entrants or who do not have the expertise or bandwidth to research and track the market and are looking for an easy and reliable way to invest in the market, TejiMandi is the go-to app. We have simplified stock market investing by providing a seamless advisory based transaction experience. We also explain the ‘why’ behind our investment decisions, and partner with investors in their entire investment journey. Our aim is to raise awareness and make wealth creation a reality for investors across the country,” Vaibhav Agrawal, Chief Investment Officer, TM Investment Technologies Pvt. Ltd., said.

Vaibhav Agrawal further added, “Unlike a PMS, where the minimum ticket size starts at 50 Lakh and pricing is dependent on AUM, TejiMandi has a flat subscription model. This is devoid of any commissions on the investment amount. We believe our proposition finds great resonance from new age or new-to-market investors.”

The app is available to download on Apple App Store and Google Play Store.

Above views are of the author and not of the website kindly read disclaimer

Tag News

Buy Dalmia Bharat Ltd For Target Rs.2,400 - Motilal Oswal Financial Services Ltd