Stocks slump, dollar up as U.S. warns of imminent Russian invasion of Ukraine

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

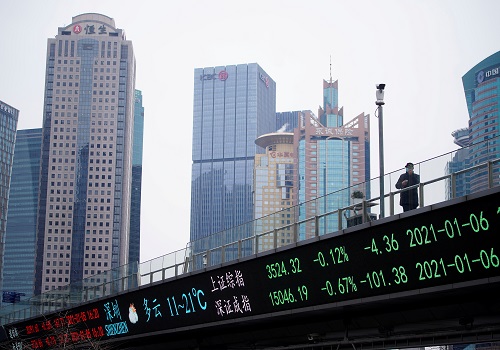

SHANGHAI - Global stocks extended a sell-off, the dollar, gold and oil prices jumped, and U.S. Treasury yields fell on Thursday amid growing fears of a full-scale Russian invasion of Ukraine.

As one of the worst post-Cold War security crises in Europe for decades worsens, U.S. Secretary of State Antony Blinken said he believes Russia will invade Ukraine within hours after separatists on Wednesday asked for Moscow's help to repel "aggression" and as explosions rocked the breakaway eastern city of Donetsk.

Airlines should stop flying over any part of Ukraine because of the risk of an unintended shootdown or a cyber attack targeting air traffic control amid tensions with Russia, a conflict zone monitor said. The warning was followed by a notice to airmen that said flights of civilian aircraft in Ukraine's airspace are "restricted due to potential hazard for civil aviation."

The crisis deepened this week after Russian President Vladimir Putin dispatched troops into parts of Ukraine, triggering sanctions from Western countries.

Asset markets have seen a sharp increase in volatility, with oil racing to near $100 per barrel and the Cboe Volatility Index, known as Wall Street's fear gauge, up more than 55% over the past nine days.

Overnight, U.S. stocks took a beating, with the Dow Jones Industrial Average down 1.38% to barely above the level that would have confirmed a correction. The MSCI World Index, a leading gauge of equity markets globally, skidded to its lowest level since April 2021.

In Asia on Thursday, the selloff showed no signs of abating.

MSCI's broadest index of Asia-Pacific shares outside Japan fell 1.6% in morning trade, with Australian shares at one point diving nearly 3%. In Tokyo, the Nikkei was 1.1% lower. Chinese blue chips fell 0.6%.

"The markets figure Russia will now do what ever it wants given how weak the sanctions were, and are pricing in an invasion," said Ray Attrill, head of FX strategy at National Australia Bank.

"The real worry is that Europe is cut off from Russian gas. The EU couldn't cope with such a supply shock and would have to rein in demand, which would be economically debilitating," he added. "Higher energy prices are also where the rubber hits the road as far as global economic growth is concerned, that's got to be bad for risk sentiment."

Investors have also been grappling with the prospect of imminent policy tightening by the U.S. Federal Reserve aimed at combating surging inflation, which NAB analysts say could be exacerbated by a commodities supply shock.

While expectations of an aggressive 50-basis-point hike at the Fed's March meeting have eased, Fed funds futures continue to point to at least six rate hikes this year. [FEDWATCH]

All the same, immediate geopolitical threats weighed on U.S. yields on Thursday, pushing the benchmark U.S. 10-year yield down to 1.9633% from its U.S. close of 1.977% on Wednesday. The 2-year yield also fell, to 1.5757% from a close of 1.6%.

The global flight to safety boosted the dollar, which rose 0.13% against a basket of other major trading partners to 96.307.

The euro was down 0.2% on the day at $1.1281

The Russian rouble turned lower, slipping 0.1% against the dollar after falling more than 3% on Wednesday.

"Markets are now more adequately pricing in the risk of something horrific happening. That combined with the uncertainty is a horrible environment to be in. No one wants risk exposure when that's floating around," said Rob Carnell, head of Asia Pacific research at ING.

Brent crude futures, which seesawed between sharp rises and falls on Wednesday, resumed a climb toward $100 a barrel on Thursday, adding 1.22% to $97.98. West Texas Intermediate rose 1.32% to $93.32 per barrel. [O/R]

Spot gold jumped as much as 0.39% to a nearly nine-month high of $1,915 per ounce. [GOL/]

(Reporting by Andrew Galbraith in Shanghai; Additional reporting by Sinéad Carew in New York, Alun John in Hong Kong and Wayne Cole in Sydney; Editing by Shri Navaratnam)

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">