Stock of the week : Elecon Engineering Company Ltd For Target Rs.s 432 - GEPL Capital

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Elecon Engineering Company Ltd is engaged in delivering power transmission solutions and material handling equipment. The company caters to the needs of various sectors like steel, fertilisers, cement, coal, lignite and iron ore mines, sugar, power stations and port mechanization in India and abroad. They have emerged as the largest gear manufacturing company in Asia. The company mainly operates through Power Transmission solutions

Investment Rationale

* Revenue Guidance of 24% fro FY23E : The company’s management is confident on a guidance of revenue of at Rs 1,500cr sales for FY23E. This implies a 24% growth on the base of FY22. For FY24E, Elecon is expected to record modest growth of 13% in the revenue. Thus, its revenue to touch Rs 1695 Cr mark by FY24E. The Profit are expected to boost as Operating leverage star kicking in. overall the topline and bottomline growth outlook is positive for the Elecon.

* Significant Reduction in Debt before Timeline: The Company was carrying a debt of Rs 335 Cr in FY21, which was repaid at standing at Rs 151 Cr as of FY22. During the Q1FY23, Elecon has become a net debt free company ahead of its scheduled timeline of FY23. This enables company to generate excess cash during the Q2,Q3 & Q4 of FY23. The cash to help as a buffer for any down cycle in future.

* Robust Order book with Strong Business Outlook: The consolidated order book position stands at Rs 617cr of which Rs 515 cr came from the Gear business. At standalone level, company continues to target order inflow rate of Rs 300 cr per quarter. Company has operations into power transmission systems and Material handling equipment. Company also receives orders from Indian navy, during qtr. it received the order of Rs 140 Cr from the Indian navy.

* Outlook and Valuations: We estimate a 24% CAGR in Topline over FY22-25E, which implies a forward PE (x) of 187.8 for FY 25E. We value it with a earnings multiple of 20.5x to FY25 earnings estimate which results per share value of Rs 432. We recommend BUY on ELECON at CMP of Rs. 375 with Target price of Rs. 432 (15%).

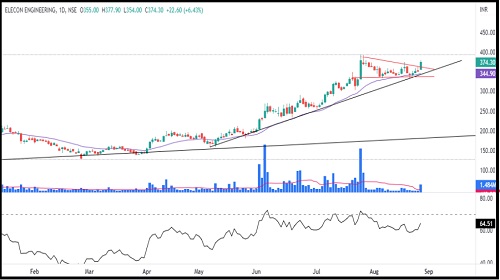

Elecon Engineering

Observation

* On Weekly chart of ELECON, Prices are in a clear uptrend, while post 22 July 2022 Stock made a base in the form of Descending Triangle pattern .

* In the latest trading session prices gave a breakout of Descending Triangle pattern, which indicated continuation in prior up trend.

* The breakout is accompanied by higher volumes, this confirms the breakout.

* Prices have closed above upper Bollinger band which points toward the increasing volatility by the prices for up move.

* RSI have sustained above 50 mark in both weekly as well as on daily timeframe which confirms that the prices have strong momentum in it.

Inference & Expectations

* The breakout is in sync with indicators and Higher Timeframe charts.

* Going ahead we expect the prices to rise higher till the level of 500.

* We recommend a strict stop loss of 350, strictly on the closing basis.

ELECON ENGINEERING COMPANY LTD : CMP : 375 Target: 432 Stop Loss : 350

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://geplcapital.com/term-disclaimer

SEBI Registration number is INH000000081.

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">