White goods & durables Sector - Steep increase in cost of ownership: Advantage companies selling value-for-money products By ICICI Securitie

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Price hikes of 20-25% over the past 18 months, ~200bps increase in interest rates as well as higher electricity rates have resulted in 13-28% increase in the cost of ownership of white goods. We note the simultaneous increase in capital as well as variable costs may result in some down-trading or slowdown in the pace of uptrading. While we model near-term impact on demand for the sector, we believe there will be relatively limited impact on companies selling value-for-money products. We continue to remain positive on Whirlpool and expect it to be the net beneficiary of down-trading (if any). Products like semi-automatic washing machines and direct cool refrigerators may continue to do better and can help Whirlpool regain some market share. However, as most white goods are problemsolution products, we do not expect any material slowdown in white goods in medium-long term. We remain positive on the sector; our top picks are Havells (BUY) and Crompton Greaves (BUY).

Increase in depreciation and interest costs: The annual depreciation has increased in line with price hikes of 20-25%. As we do not model any material correction in the prices of white goods, we believe depreciation cost will remain at elevated level. There is ~200bps increase in interest rates and hence, funding cost to purchase white goods has increased by ~20%.

Power cost has increased with higher electricity rates:: The electricity cost has increased by ~4% due to the increase in electricity rates. We also note the consumption of white goods at home has increased due to work-from-home culture

Highest increase in cost of ownership of washing machines:The cost of ownership has increased and is highest in case of washing machines (up ~28% YoY) whereas the cost of ownership has increased by just 13% in case of air conditioners.

Increase in capital and variable costs to hurt consumption in near term:: Steep increase in capital as well as variable costs for consumers may impact white goods consumption in near term. We also believe there is a high probability of down-trading in the sector. As most white goods are problem-solution products, we do not expect any material slowdown in the sector in medium-long term.

Sector view and top picks:: Considering the strong return ratios, healthy growth potential and low penetration levels, we remain structurally positive on white goods and durables sector. Havells and Crompton Greaves are our top picks. Key risks: Higher-than-expected rise in input prices, delay in price hikes to protect margins and irrational competition.

To Read Complete Report & Disclaimer Click Here

For More ICICI Securities Disclaimer https://www.icicisecurities.com/AboutUs.aspx?About=7 SEBI Registration No.:- INZ000205331

Above views are of the author and not of the website kindly read disclaimer

More News

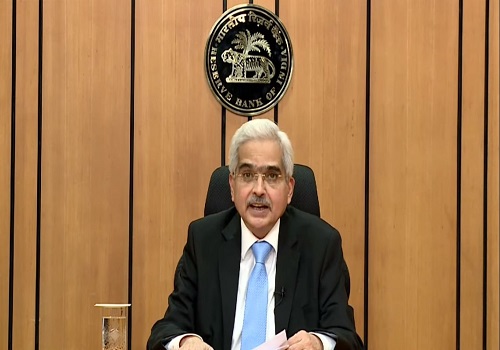

Banking Sector Update - Accelerating growth, improving asset quality bode well for banks By ...

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">