Some profit booking at record highs, broader market continue to sulk by Mr. Sameet Chavan, Angel Broking

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Below is quote on Market Wrap Up - Some profit booking at record highs, broader market continue to sulk by Mr. Sameet Chavan, Chief Analyst-Technical and Derivatives, Angel Broking

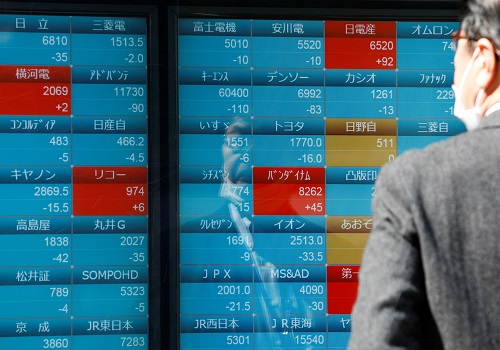

The SGX Nifty was indicating a sluggish start early in the morning; but once again we shrugged off these cues and opened with a small upside gap. As the day progressed, the buying in some of the heavyweights picked up, resulting in marking a new high of 16359.25 in Nifty. However, all of a sudden, markets started correcting sharply at the stroke of the penultimate hour. In the process, we not only erased all gains but went on to test the 16200 mark. Fortunately, a modest recovery towards the end pulled the index back into the positive territory.

Since morning, the banking was showing tremendous strength which provided some impetus for Nifty to register a new high. However, traders chose to take some money off the table in the latter half and it needs to be considered a normal phenomenon after last week’s swift rally. From now onwards, things are likely to be this way only as it would be hard for the index to keep up the same pace. Hence, traders are advised to be a bit vigilant going ahead and should ideally avoid aggressive bets. As far as levels are concerned, 16200 followed by 16100 are to be considered as strong support levels; whereas on the higher side, today’s high should be treated as an immediate hurdle. If Nifty has to make a move towards 16500, the banking index needs to stabilise beyond 36200. Until then we are likely to see similar profit booking moves at higher levels. Also, the broader market has been sulking since last 3 – 4 days, which is making traders’ lives miserable. The stock selection has become extremely difficult and hence, one should remain light on positions.

Above views are of the author and not of the website kindly read disclaimer

Tag News

On the higher side, immediate resistance is seen around 36000 - 36200 levels - Angel One