Shock Swiss rate hike sets markets on edge ahead of BOJ

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

SINGAPORE - World stocks on Friday headed for their worst week since markets' pandemic meltdown in March 2020, as investors feared sharp rate hikes tipping economies into recession, while growth fears and a soaring Swiss franc whacked the U.S. dollar.

A shock 50 basis point rate hike from the Swiss National Bank overnight sent the franc on its sharpest rise in seven years, forced an unwind of carry trades and set off a new round of worry that rising global rates will snuff out growth.

It has also left the Bank of Japan utterly lonely in its low-rate settings, stoking nerves that policymakers will adjust or abandon them later on Friday.

That risk had lent the yen some support this week, but it was sliding and down nearly 1% against the dollar to 133.27 per dollar in morning trade. [FRX/]

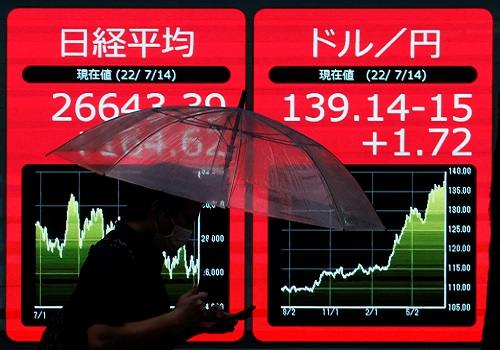

MSCI's broadest index of Asia-Pacific shares outside Japan fell to a five-week low, dragged by selling in Australia where the ASX 200 dropped 2% and was on course for a 7% weekly fall. Japan's Nikkei fell 2.4%, while shares in China - where rate rises are not an imminent worry - were outliers with modest gains.

Overnight the Nasdaq tanked, dropping 4%, and the S&P 500 fell 3.3%. World stocks are down 5.7% for the week so far, on course for the steepest weekly percentage drop in more than two years.

The Bank of England also announced a 25 basis point rate rise overnight, smaller than expected, which has served only to reinforce bets that even bigger hikes are coming later.

"Global money is getting more expensive, and it has a way to go yet," said ING's Asia economist Rob Carnell.

All eyes will be on the BOJ during Asia hours, with a decision due between 0230 GMT and 0400 GMT.

Trade in Japan's usually subdued bond market has been wild in recent days as speculators pile in to short futures and cash bonds in a bet on the BOJ capitulating.

Ten-year Japanese government bonds traded just above the BOJ's de-facto 0.25% yield target on Friday morning. [JP/]

While not forecasting any shift, Deutsche Bank strategist Alan Ruskin expects markets would react violently to any policy changes. "Expect a snap in JGB 10-year yield by 50 bps ...USD/JPY down by 5 big figures initially (and) Nikkei -5%," he said.

ONE WAY

Bonds had a wild overnight session with German debt dumped after the Swiss rate hike and a European Central Bank plan to direct its bond buying toward periphery nations, before growth fears pared the heaviest losses.

Two-year German bund yields finished the session up 8.5 bps to 1.152% and the 10-year bund yield rose 5 bps to 1.703%. [GVD/EUR]

U.S. labour and housing data came in soft on Thursday, on the heels of disappointing retail sales figures, with the worries knocking the dollar and helping Treasuries.

Benchmark 10-year Treasury yields fell nearly 10 bps overnight but wobbled higher to 3.2461% during Asia's morning. Yields rise when prices fall. [US/]

Sterling rose 1.4% on the dollar overnight in anticipation of aggressive Bank of England hikes to come. The euro rose 1% and held around $1.0535 in Asia.

"One phenomenon in the market appears to be a reaction to if a central bank does not move aggressively, yields and risk price in more in the way of rate hikes down the road," said NatWest Markets' strategist John Briggs.

"Alternatively, markets may just be continuously adjusting to an outlook for higher global policy rates ... as global central bank policy momentum is all one way."

Another factor dragging on the dollar was the Swiss franc's surge, since it is used as a funding currency and often changed for dollars before those are swapped for high yielders - meaning dollars get sold when that trade reverses.

Growth fears took oil on a brief trip lower overnight before prices steadied. Brent crude futures were last at $118.96 a barrel. Gold held at $1,846 an ounce and bitcoin was kept under pressure at $20,700.