September 2022 : Monthly Equity Outlook By George Thomas, Quantum AMC

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Monthly Equity Outlook for September 2022 by George Thomas, Associate Fund Manager, Quantum AMC

S&P BSE SENSEXadvanced by 3.6% on a total return basis in the month ofAug 2022.It has outperformed developed market indices likeS&P 500 (-4.1%)and Dow Jones Industrial Average Index (-3.7%).S&P BSE SENSEX has also outperformed MSCI Emerging Market Index (0.4%). The rally was broad-basedS&P BSE Midcap Index &S&P BSE Smallcap Index advancedby 5.8% and 6.1% respectively. Stable domestic macrosand corporate earnings, moderation in commodity prices, and hope of aslowdown in the pace of rate hikes across the globe triggered the rally. But the hawkish commentary by JeromePowell at the Jackson Hole conference tempered the hopes of slow rate hikes. Global macro headwinds translating to a potential slowdown in IT spends led to underperformance of the IT sector during the month. Barring BSE IT & BSE Teck, all sectoral indices advanced during the month. Early signs of a potential revival in private CAPEXand a pickup in consumption with the advent of the festive season were reflected in the strong performance of Capital Goods and Consumer Durable indices.

FPIscontinued to be net buyers in August at US$ 6.4 bn.Domestic institutional investors(Mutual Funds & Insurance put together)turned sellers to the tune of $825 mn in August. FPIs cumulatively recorded a net outflow of USD 21.4 bn since Jan 2022. In the same timeframe, DIIs recorded a net inflow of USD 31 bn.

Quantum Long Term Equity Value Fund (QLTEVF) saw an increase of3.3% in its NAV in the month of Aug 2022. This compares to a 4.8% increase in its Tier I benchmark S&P BSE 500 &4.7% increase in its Tier II Benchmark S&P BSE 200. The relative underperformance of our holdings in energy, industrials, and utilities compared to sector peers resulted in underperformance. Auto and healthcare stocks in the portfolio performed better than their sector peers. Cash in the scheme stood at approximately 4.6% at the end of the month. The portfolio is valued at 13.0x FY24E consensus earnings vs. the S&P BSE Sensex valuations of 18.8x FY24E consensus earnings.

Macros largely look stable

Despite global headwinds, Indian macros appear to be relatively stable. India’s GDP grew by 13.5% in 1QFY23. Quarterly GDP surpassed the pre-covid level by 3.3%. Though the GDP growth was below estimates, arevival in domestic demand was visible in stronggrowth in private consumption (59.9% of GDP) at 9.1%compared to the pre-pandemic level (Q1,FY20). Gross Fixed Capital Formation (34.7% of GDP) recorded a growth of 3.6% in the same period.

GST collection remained above INR 1.4 trillion for the sixth consecutive month in August. Improved compliance, consumption, and elevated inflation contributed to the robust GST collection. Direct tax collection during April-Aug 2022 recorded a growth in excess of 30%. Robust tax collection would enable Government to pursue infrastructure projects despite elevated crude prices.

Monsoon is vital in India as more than half of the country’s farmland doesn’t have irrigation. India received 6% more rainfall than average in the first three months of June-Sep monsoon season.

But there is a deficit in states such as UP and Bihar. Despite this, the sowing of all crops (pan-India) is just lower by 1.3% compared to 2021 (Data as of Sep 2, 2022). Among major crops, the acreage of rice is 5.6% lower compared to the prior year while pulses (+0.4%), coarse cereals (+4.3%), and cotton (+6.8%) recorded growth in cultivation compared to past years.

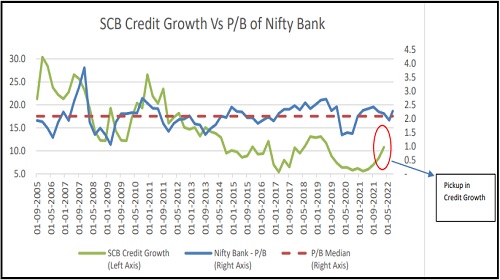

Credit Growth continues to strengthen

Pick up in credit growth despite the rising interest rates depict the strength of the ongoing economic recovery. As per the RBI release, Non-Food Credit grew by a healthy 15.1% on a yearly basis, retail loans grew at a robust 18.8% supported by growth across secured and unsecured segments.Growth in industry loans gained pace to 10.5%. (Data as of July 2022). Though part of the loan growth is inflation-led, steady improvement in capacity utilisation of the manufacturing sector to 75.3% in Q4FY22 (Source: RBI Survey) augurs well forCAPEX led corporate loan demand.

Banks: Improving Credit Demand amid Reasonable Valuation

Above views are of the author and not of the website kindly read disclaimer

As of August 31, 2022, the fund holds an outsized position in the financial sector.We believe Indian banks are in one of the best positions to fund the revival in credit demand. Capital Adequacy Ratio of SCB (Scheduled Commercial Banks) rose to a new high of 16.7% as of Mar-2022 against the regulatory requirement of 9%. The bad loans indicated by the gross non-performing assets (GNPA) ratio for Scheduled Commercial Bank (SCB) fell to a sevenyear low of 5.9% as of Mar-2022. This would further augment the banks’ capabilityto lend as low provisioning requirementswould boost the profitability. Despite the pandemic, corporate balance sheets have strengthened over the past two years. Reasonable valuation along with improving credit demand outlookand stable asset quality make banks a compelling investment from a medium-term perspective.

Rising global macro uncertaintiesand global interest rates could impact exports and foreign flows in the near term. Notwithstanding the near-term noise, Indian markets are better positioned relative to their global peers. Reasonably stable macros, domestically driven demand, a strong banking system, and manageable inflation would help India to stay on course. We recommend investors continue with their SIP and stay invested in equities with a long-term horizon

To Read Complete Report & Disclaimer Click Here

Above views are of the author and not of the website kindly read disclaimer

Tag News

We anticipate immense potential benefits from the upcoming Sovereign Gold Bond Tranche in FY...

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">