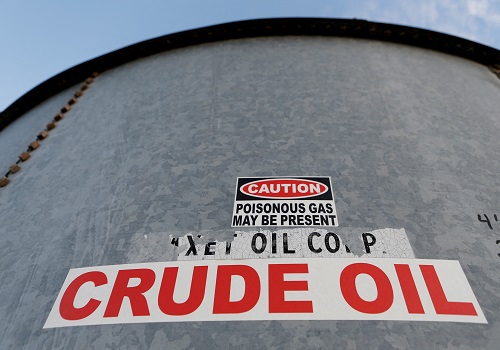

S&P Global Commodity Insights: Russian crude flows to India, China proving a boon for other Asian oil importers

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

The insatiable appetite for discounted Russian cargoes from India and China has offered enough bandwidth to Middle Eastern suppliers to cater to the needs of other Asian oil importers that have that slashed their purchases from the largest non-OPEC supplier since the invasion of Ukraine last February.

"The trends that we saw in Asia in 2022 are likely to continue this year, with China and India importing large volumes of crudes from Russia, while South Korea has cut back buying from the same supplier substantially and Japan not importing from that country," said Lim Jit Yang, adviser for Asia-Pacific oil markets at S&P Global Commodity Insights.

According to industry and some government officials, the big shift in focus of India and China toward Russian crude has softened the competition for Middle Eastern crude in Asia, leaving enough room for those oil producers to even cater to the needs of some European buyers.

Surge in imports

Russian crude's share in the Indian crude basket in 2021 was only around 2.2%, according to S&P Global Commodity Insights. From that level, Russia became India's top crude supplier in November 2022, with the country receiving around 1 million b/d, and were on course to be even higher in December, estimated at 1.24 million b/d, due to competitive landed costs.

Over January-November, China's crude imports from Russia rose 10.2% year on year to 79.78 million mt, or 1.75 million b/d, customs data showed.

ESPO crude arrivals in Shandong ports for independent refineries soared 36.6% from November to a 31-month high of 2.6 million mt, or 614,774 b/d, in December, according to S&P Global data. The increase suggested Shandong refineries were confident in importing Russian barrels despite the price cap imposed Dec. 5.

Market sources said Middle Eastern sour crude procurement had been smooth due to Indian and Chinese refiners' willingness to take more Russian crude that has helped to meet the revival in demand after the lifting of pandemic restrictions. This has worked in favor of the region's overall crude supply security.

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">