S&P 500, Dow hit record highs on bank earnings boost

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

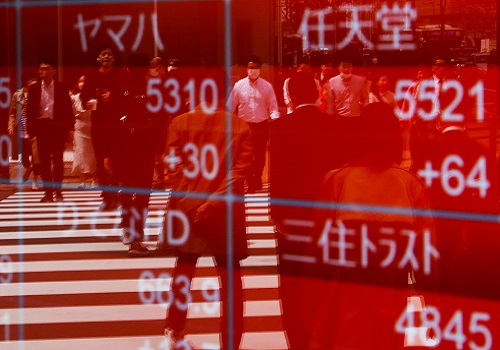

The S&P 500 and the Dow hit record highs on Friday after Morgan Stanley wrapped up bumper quarterly earnings reports from big U.S. banks, while optimism about a solid economic rebound put the main indexes on course for weekly gains.

Nine of the 11 S&P indexes were higher, with only the information technology and the energy indexes edging lower after outperforming in the previous session.

The benchmark S&P 500 and the blue-chip Dow are on course for their fourth straight week of gains, while the technology-heavy Nasdaq is less than a percent below its own all-time closing high on the back of upbeat economic data and a solid start to the first-quarter corporate earnings season.

"You are just seeing blow out earnings from the banks and all the data pointing to a very strong reopening," said Thomas Hayes, chairman of Great Hill Capital.

"So it's a day for (the so-called) 'reopening trade' with strong financials."

Morgan Stanley reported a 150% jump in quarterly profit on Friday, joining JPMorgan Chase & Co, Goldman Sachs Group Inc and Bank of America in reinforcing hopes of a swift economic recovery.

Still, the investment bank's shares fell 2.9% as it also disclosed an almost $1 billion loss from the collapse of private fund Archegos.

Shares of JPMorgan, Goldman Sachs, Bank of America, and Wells Fargo & Co rose between 0.7% and 2.4%, while the S&P financials index was up 0.4% after hitting a record high earlier in the day.

By 12:04 p.m. ET, the Dow Jones Industrial Average was up 101.65 points, or 0.30%, at 34,137.64, the S&P 500 was up 8.02 points, or 0.19%, at 4,178.44, and the Nasdaq Composite was down 7.80 points, or 0.06%, at 14,030.96.

The Federal Reserve's pledge to keep interest rates low despite higher inflation has also revived demand for richly valued technology stocks, although bond yields edged higher again on Friday after hitting multi-week lows in the previous session.

Tech behemoths Apple Inc, Amazon.com Inc, Tesla Inc and Microsoft Corp, which led Wall Street's recovery last year from the coronavirus-fueled crash, slipped between 0.2% and 1.5%.

The information technology index pulled back from an all-time high hit in early trading.

"The biggest risk that could cause a (stocks) sell off is the development of COVID-19 variants, a slowdown in the reopening and persistent inflation," Hayes said.

Bitcoin-related stocks including Riot Blockchain and Marathon Digital slumped about 4% after Turkey banned the use of cryptocurrencies and crypto assets to purchase goods and services.

Advancing issues outnumbered decliners 1.15-to-1 on the NYSE, while declining issues outnumbered advancers 1.53-to-1 on the Nasdaq.

The S&P index recorded 136 new 52-week highs and no new low, while the Nasdaq recorded 129 new highs and 91 new lows.

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">