Rupee future maturing on November 26 appreciated by 0.06% yesterday - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Rupee Outlook and Strategy

The US dollar rose 0.38% yesterday amid improved economic data from the US. Weekly jobless claims fell sharply to the lowest level in 52 years. Further, FOMC meeting minutes showed that some officials are prepared to accelerate the pace of ending bond buying programme and raise rates sooner than anticipated if inflation does not moderate. Additionally, core PCE price index showed inflation remained elevated in October

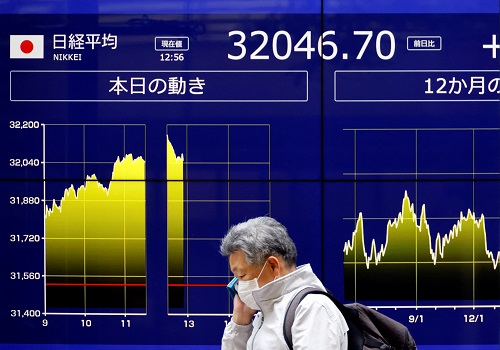

Rupee future maturing on November 26 appreciated by 0.06% yesterday as some foreign banks sold dollar. However, sharp gains were prevented on persistent FII outflows and firm dollar

The rupee is expected to depreciate on a strong dollar, FII outflows and rise in crude oil prices. Further, the rupee may slip on risk aversion in the domestic markets. Investors fear that rise in interest rates in major counties across globe to tackle elevated inflation may lead to outflows of overseas investments

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

EURINR trading range for the day is 89.13 - 89.49. - Kedia Advisory

More News

The pound is expected to trade with a negative bias amid concern over economic growth - ICIC...

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">