US dollar continued its rally amid risk aversion in global markets and surge in US treasury yields - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Rupee Outlook and Strategy

• US dollar continued its rally amid risk aversion in global markets and surge in US treasury yields. Yields extended gains after non-farm payrolls data showed economy added 428K jobs in April above the market expectations for 400K. However, further upside was capped as average hourly earnings rose just 0.3% below estimate of 0.4% gain

• Rupee future maturing on May 27 depreciated by 0.75% amid strong dollar and risk aversion in the global markets. Further, rupee slipped on surge in crude oil prices

• The rupee is expected to depreciate today amid firm dollar and pessimistic global market sentiments. Market sentiments were hurt as investors are concerned over surging inflation, monetary policy tightening across major countries in the globe, economic slowdown and escalating geopolitical tensions. Moreover, market participants fear that rising crude oil prices will hurt India’s trade and current account. US$INR (May) is expected to trade in a range of 76.80-77.25

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Above views are of the author and not of the website kindly read disclaimer

Tag News

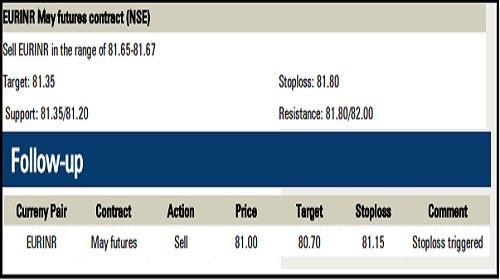

EURINR trading range for the day is 89.13 - 89.49. - Kedia Advisory

More News

USDINR has appreciated after strong US jobs data and comments from Fed member have strengthe...

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">