Rupee future maturing on March 29 depreciated by 0.55% amid strong dollar - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

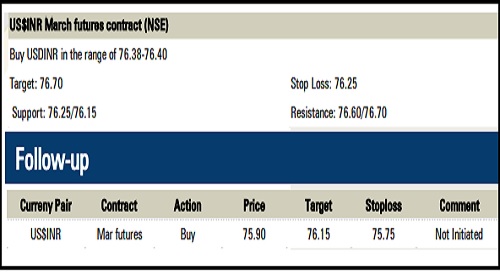

Rupee Outlook and Strategy

The US dollar rallied by 0.29% yesterday amid a surge in US treasury yields and decline in US stocks. Further, the dollar rose after Federal Reserve Chairman Jerome Powell reiterated that the central bank is committed to control inflation through a rapid series of interest rate hikes

Rupee future maturing on March 29 depreciated by 0.55% amid strong dollar, risk aversion in domestic markets and surge in crude oil prices

The rupee is expected to depreciate today amid a firm dollar, weaker financial markets. Market sentiments are hurt on fears that rate hike will lead to higher borrowing cost denting global growth prospects. Further, elevated oil prices have prompted concerns on sustained high inflation, lower economic growth. Also, rupee may slip further on capital outflows due to sustained selling by FPIs

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Above views are of the author and not of the website kindly read disclaimer

Tag News

EURINR trading range for the day is 89.13 - 89.49. - Kedia Advisory

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">