Rupee future maturing on August 26 depreciated by 0.45% on Monday - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Rupee Outlook and Strategy

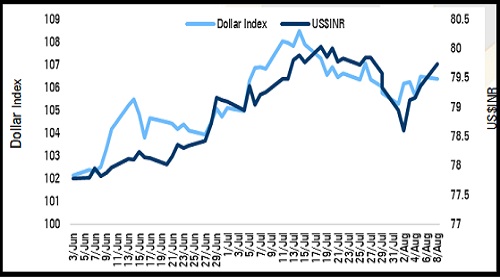

* The US dollar declined almost 0.20% on Monday as investors looked ahead to Wednesday's inflation data for more clues about the Federal Reserve's next steps. Further, the US dollar was pressurised by a drop in US 10-year treasury yields. However, sharp downside was prevented as Fed Governor Michelle Bowman said on Saturday that the US central bank should consider more 75 bps hikes at coming meetings to bring inflation back down

* Rupee future maturing on August 26 depreciated by 0.45% on Monday amid rise in crude oil prices

* The rupee is expected to appreciate today amid weakness in the US dollar and persistent foreign fund inflows into the capital market. Further, investors will remain vigilant ahead of CPI YoY data from the US, which is expected to ease from 9.1% to 8.7%. US$INR (August) is expected to trade in a range of 79.80-79.50

Dollar Index vs US$INR

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631

Above views are of the author and not of the website kindly read disclaimer

Tag News

EURINR trading range for the day is 89.13 - 89.49. - Kedia Advisory

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">