Rupee future maturing on August 26 depreciated by 0.33% on Friday amid sharp drop in domestic equity market - ICICI Direct

Rupee Outlook and Strategy

• The US dollar edged higher by 2.30% on Friday as investors adjusted for the likelihood that the Federal Reserve will keep hiking rates to battle inflation. Further, the dollar was supported by rise in US 10 years treasury yields. Moreover, the value of the net long dollar position climbed to $13.37 billion in the week ended August 19, from $12.97 billion the previous week, CFTC data showed. Net long dollar positions have increased for the first time in four weeks

• Rupee future maturing on August 26 depreciated by 0.33% on Friday amid sharp drop in domestic equity market and rise in crude oil prices

• The rupee is expected to depreciate today amid strong US dollar index. Further, the rupee may be pressurised by weakness in domestic equities. Moreover, drop in Indian forex reserves may pressurise Rupee. Forex reserves dropped from $$572.98 bn to $570.74 bn. US$INR (August) is likely to trade in range of 79.80-80.00

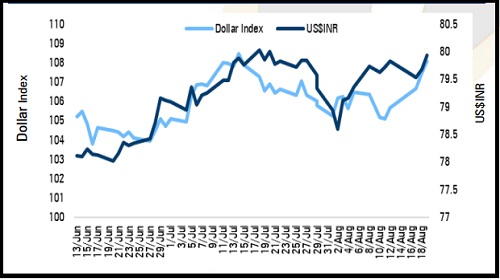

Dollar Index vs US$INR

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631

Above views are of the author and not of the website kindly read disclaimer