Rupee future maturing on April 27 appreciated by 0.21% tracking weakness in dollar - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

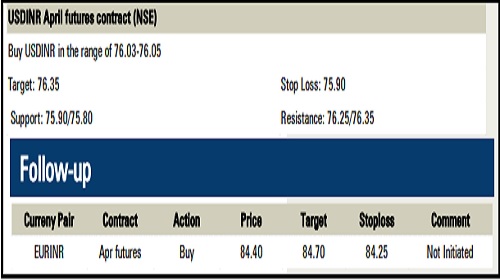

Rupee Outlook and Strategy

The US dollar slipped by 0.58% yesterday amid a decline in US treasury yields and disappointing economic data from US. US ADP non-farm employment change data showed private sector added 455,000 jobs in March lower than previous month. GDP data showed the economy expanded by 6.9% in Q4CY21, revised down from 7% pace estimated in February

Rupee future maturing on April 27 appreciated by 0.21% tracking weakness in dollar and ease in crude oil prices. Further, the rupee gained strength on optimistic domestic market sentiments

The rupee is expected to depreciate today amid risk aversion in the global markets and persistent FII outflows. Further, investors will remain cautious ahead of major economic data from the US and Opec+ meeting. Strong labor market and elevated inflation will further strengthen the case for aggressive monetary tightening by Fed. Meanwhile, weakness in dollar and softening of crude oil prices may prevent further downside in rupee

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Above views are of the author and not of the website kindly read disclaimer

Tag News

EURINR trading range for the day is 89.13 - 89.49. - Kedia Advisory

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">