Rupee February futures appreciated by 0.51% on the back of retreat in dollar - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

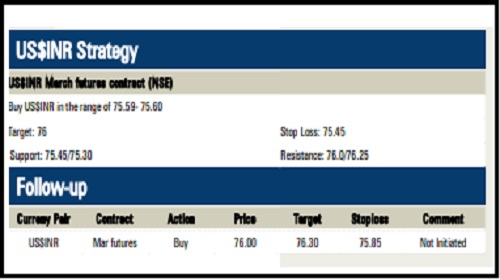

Rupee Outlook and Strategy

The dollar index declined 0.54% on Friday amid rise in risk appetite in the global markets and decline in US treasury yields. However, improved macroeconomic data from the US and rising tensions in Ukraine cushioned a further decline in the dollar

Rupee February futures appreciated by 0.51% on the back of retreat in dollar and softer crude oil prices

The rupee is expected to depreciate today due to expectations of disappointing GDP data from India. Further, continuous FII fund outflows from domestic markets will weigh on the rupee. Moreover, pessimistic sentiments in the global markets may continue to put pressure on the rupee. Additionally, investors will keep an eye on Chicago PMI data from the US. US$INR (March) is likely to rise towards 76.10 for the day

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Above views are of the author and not of the website kindly read disclaimer

Tag News

EURINR trading range for the day is 89.13 - 89.49. - Kedia Advisory

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">