Rising interest rates to help Indian banks post healthy profits in FY23: S&P Global Market Intelligence

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

S&P Global Market Intelligence in its latest report on the Indian banking sector has said that the rising interest rates will enable Indian banks to continue posting good profits during the remaining part of FY23. It stated five of the six biggest banks by assets in India reported an increase in net income for the fiscal second quarter ended September 30, 2022.

It mentioned ‘Banks took advantage of the higher interest rate environment to bolster their net interest margins, while previous efforts to reduce their non-performing assets resulted in lesser loan loss provisions, their recently released earnings reports showed.’

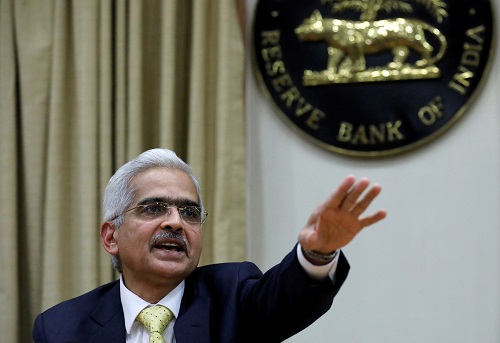

Besides, citing the Reserve Bank of India's (RBI) data, it said the bank credit growth has picked up for both public and private sector banks in the first half of fiscal 2022-2023. Private sector banks' credit growth for the fiscal first half came to 20.4 per cent, compared to 13.9 per cent for public sector banks. According to the report, though the RBI had hiked its benchmark lending rate by 190 basis points to 5.90 per cent since May, further hike in the interest rate may not be steep since inflation may have peaked.