RILpartners with Brookfield Infra, Digital Realty for India data centre business

Reliance Industries Limited (RIL) on Monday announced entering into an agreement to invest alongside Brookfield Infrastructure and Digital Realty in their Indian SPVs set up for developing data centres in the country.

RIL will hold 33.33 per cent stake in each of the Indian SPVs and become an equal partner.

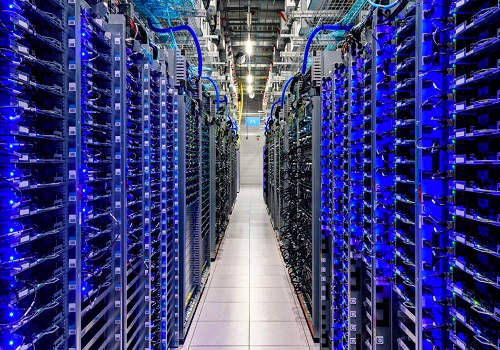

Digital Realty Trust is the largest provider of Cloud and carrier-neutral data centre, co-location and interconnection solutions globally with 300+ data centres across 27 countries.

It has a joint venture (JV) with Brookfield Infrastructure that is developing high-quality, highly-connected, scalable data centres to meet the critical infrastructure needs of enterprises and digital services companies in India.

RIL will become an equal partner in the JV. The JV will be branded as ‘Digital Connexion: A Brookfield, Jio and Digital Realty Company’.

The JV is currently developing data centres in marquee locations of Chennai and Mumbai. The JV’s first 20 megawatt (MW) greenfield data centre (MAA10), on a 100 MW campus in Chennai, is expected to be completed by the end of 2023.

The JV recently announced the acquisition of 2.15 acres of land in Mumbai, to build a 40 MW data centre. Given the location of these sites, the data centres will be connected to critical terrestrial connectivity infrastructure, as well as undersea cables, and will become hubs for global connectivity for Indian companies and gateways into India for multi-national companies.

Data centre capacity in India is expected to increase multi-fold over the next few years. Indians are already amongst the largest mobile data consumers globally.

This will further increase significantly with increasing access to various digital services like OTT platforms and gaming and the ongoing 5G roll-out. Adoption of 5G use cases by enterprises will lead to the adoption of data-intensive technologies like internet of things (IoT) and artificial intelligence (AI).

The ongoing innovations in generative AI technology have been enabled by hardware and data centre infrastructure, and the requirement of these is only set to increase exponentially.

There is also an increased emphasis on localisation of personal data within the country. These drivers will significantly increase the data centre and compute capacity requirements of the country.

The JV will be well positioned to serve global and local enterprises, SMBs and the vibrant start-ups of India, for their cloud and colocation requirements as they move their compute resources on the cloud and off-premise.

Data centres developed by the JV will leverage Digital Realty’s industry-leading energy-efficient data centre platform design and operating procedures, highly-repeatable pervasive data centre architecture approach and relationships with global customers.

They will also leverage Brookfield’s in-depth knowledge of the Indian infrastructure market, and Jio’s massive digital and connectivity ecosystem and very strong enterprise relationships with an existing client base of 80 per cent of large named private enterprises in India.

Jio’s world-class 4G and 5G connectivity network with deep fiber presence strategically expands the JV’s connectivity to data centres and other establishments in the country.

It extends the reach of PlatformDIGITAL, Digital Realty’s best-in-class global data centre platform with 300+ data centres, in 50+ metros, across 27 countries and giving continents, giving customers access to a dense connected data community of partners, solutions and services, including Jio’s network, Cloud and other service solutions in India.

Speaking about the transaction, Kiran Thomas, CEO, Jio Platforms Limited, said, “We are excited to partner with Digital Realty, one of the most innovative data centre companies globally and with Brookfield, our existing and trusted partner.

"The partnership will help us serve our enterprise and SMB clients with cutting-edge, plug-and-play solutions delivered from the cloud and lead their digital transformation and make them more competitive and efficient.

"The unique and highly engaging consumer and home experiences that we are offering and further innovating on, such as high-definition live content, AR / VR experiences, cloud gaming, immersive shopping experiences and cloud PC have massive compute capacity requirements.

"We would like to thank the Indian government for granting infrastructure status to data centres and for creating a favorable ecosystem for their development and operations, which is critical for India’s vision to become a $1 Trillion digital economy by 2025.”

Arpit Agrawal, Managing Director, Head of Infrastructure, India & Middle East, Brookfield, added, “We are very pleased to expand our existing partnership with Reliance and add their deep expertise in the Indian telecom, tech and data landscape to the platform.

"Data centres provide essential services and critical infrastructure to support the digitalization that is taking place in every aspect of life in India. Together with Reliance and Digital Realty, we look forward to providing the best of solutions to the digital transformation needs of Indian and global corporates.”

Serene Nah, Managing Director and Head of Asia Pacific, Digital Realty, said, “India is a mostly untapped market for the data centre industry driven by the rapid adoption of digital business models, the world’s largest population, and a government that recognises the role of technology for future economic development.

"This joint venture brings together three global leaders in digital infrastructure to accelerate Digital India by developing, owning and operating institutional quality carrier-and cloud neutral data centres across India.”

Shardul Amarchand Mangaldas acted as legal advisors, and Deloitte, Haskins & Sells LLP acted as accounting and tax diligence advisor to RIL.

The transaction is subject to regulatory approvals and is expected to be completed in around three months.