RBI Monetary Policy Reaction : Housing prices are expected to largely remain firm in the upcoming quarters Ramesh Nair, Colliers

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

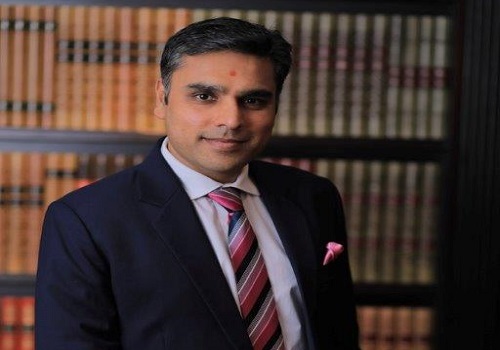

Below Quote on RBI Monetary Policy Announcement By Ramesh Nair, CEO, India and Market Development, Asia, Colliers

"The Reserve Bank of India increased the repo rate by 25 bps in February 2023. This sixth increase in a row adds to the 225 basis points increase seen in 2022 alone. This rate increase, which is lower than last time, reflects the government’s unwavering attempt to tackle inflation over the last few months. The retail inflation rate started easing in the latter part of 2022 now hovering within the government’s target below 6%, although core inflation continues to be sticky. If inflation continues to show positive outcomes combined with encouraging high performance economic indicators, we hope to see fewer rate hikes or negligible rate hikes by the RBI, going ahead.Home loan interest rates are already in the higher bracket of 8-9% in recent times. Further, housing prices are expected to largely remain firm in the upcoming quarters. On the optimistic side, we hope not to foresee a further rise in the repo rate and a resultant increase in loan rates. This will help sustain the demand and confidence of homebuyers in the market"

Above views are of the author and not of the website kindly read disclaimer

Tag News

Expert Views on Colliers Release : Institutional investments in alternatives cross USD2.0 Bn...

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">