RBI MPC Review : Measured approach to transition By Emkay Global

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

Measured approach to transition

* As expected, the RBI avoided a cliff edge in the December policy by keeping the fixed reverse repo rate unchanged. The redistribution/re-pricing of existing liquidity via VRRR tenor/quantum/cut-offs has smoothly helped the alignment of some money market rates toward the repo rate, and the central bank chose to continue the same gradualist approach ahead.

* In order to re-establish the 14-day VRRR auction as the main operation tool, its quantum has been consistently increased ahead, resulting in effective tightening. From CY22, liquidity management will mainly happen through the auction route, making the fixed overnight reverse repo less relevant.

* Even as the weighted average reverse repo rate is around 3.8%, the call money rate and TREPS are still hugging the fixed RR rate, which continues to absorb ~Rs2-2.5tn liquidity. Thus, RepoRR corridor normalization will remain on the anvil in coming months. We do not rule out the introduction of SDF as a tool at a lower bound next year as reverse repo becomes floating. However, to start with SDF, the RBI might have to put a cap on the utilization of reverse repo for regular operation.

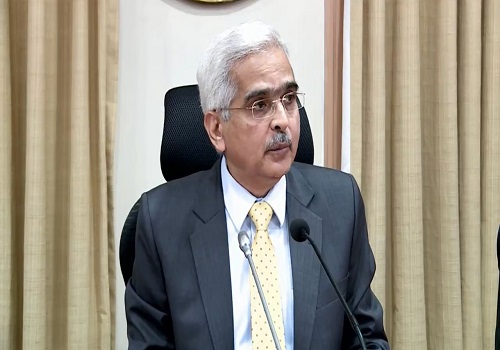

The dissent continues on accommodative stance

As expected, the MPC unanimously kept the key rates unchanged and reiterated its accommodative stance both on rate and liquidity fronts. However, Prof Jayanth Varma’s dissent on the continuation of the accommodative stance for the foreseeable future keeps the MPC in a split state. The minutes will throw light on the evolution of the thought processes of other budding dissenters on (liquidity/policy) normalization and accommodation. The MPC maintained that the still sub-par growth needs continued policy support for a durable revival. Real GDP growth projection for FY22 is retained at 9.5% (Emkay: 10.1%), assuming no new Covid shocks. Headline CPI inflation is kept unchanged at 5.3% for FY22 (Emkay: 5.4%), with the October-December CPI forecast raised from 4.5% to 5% and January-March forecast cut from 5.8% to 5.7%. The risks are seen as broadly balanced, with cost-push pressures and prevailing supply-side bottlenecks being countered by expectations of lower food prices and weak demand. The governor maintained that amid demand slack, the pass-through to output prices and core inflation is getting tempered. While fuel excise tax reduction will lead to a second-round impact, the MPC advised continued rationalization of fuel taxes.

Slow but steady steps on liquidity repricing

As we expected, the RBI avoided a cliff edge in the policy with any reverse repo rate hike. The redistribution/re-pricing of existing liquidity via VRRR tenor/quantum/cut-offs has smoothly helped the alignment of some money market rates toward the repo rate, and the central bank chose to continue the same gradualist approach ahead.

1) Higher VRRRs ahead: The RBI reaffirmed its aim to re-establish the 14-day VRRR auction as the main liquidity management operation tool amid bumper liquidity. The quantum of 14-day VRRRs is being increased consistently – going to Rs7.5tn by Dec’21, while the governor stated higher tenor of 28-day or quantum would be used as per the need of the system. But we note that banks had under-subscribed to the 14-day window in the last three auctions, partly as other tenor VRRR auctions were also conducted.

2) Liquidity re-pricing entrenched: From CY22 onward, the liquidity management will mainly happen through the auction route, making the fixed overnight reverse repo largely irrelevant, and thus making the reverse repo floating. This, we believe, will make liquidity re-pricing effectively tighter.

Transition ahead – new tools may still be on the anvil

The RBI will likely tread cautiously on market preparation. The current liquidity flux looks somewhat sticky ahead (if not addressed), with an increase in currency in circulation being offset by the government drawdown in surplus and possible capital flows and forwards maturities. The use of any blunt tools to suck out the liquidity does not seem to be happening. Even as the weighted average reverse repo rate is around 3.8%, the call money rate and TREPS are still hugging the fixed reverse repo rate, whose window continues to absorb around Rs2-2.5tn of liquidity. Thus, corridor normalization will remain on the anvil. We do not rule out the introduction of SDF as a tool at a lower bound next year as the effective reverse repo rate becomes floating. The introduction of uncollateralized SDF could significantly enhance the central bank's sterilization capacity, especially as the liquidity deluge dilemma will continue in the coming months as well. However, to start with SDF, the RBI might have to put a cap on the utilization of fixed reverse repo for regular operation.

To Read Complete Report & Disclaimer Click Here

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354

Above views are of the author and not of the website kindly read disclaimer

Top News

Cabinet approves continuation of Pradhan Mantri Awaas Yojana (Rural) for another three years

Tag News

Monthly Debt Market Update, September 2023: CareEdge Ratings