Perspective on SGB Tranche 4 by Nish Bhatt, Millwood Kane International

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

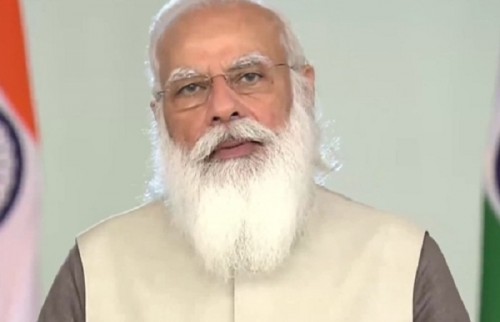

Below are Views On Perspective on SGB Tranche 4 by Mr. Nish Bhatt, Founder & CEO, Millwood Kane International

“ The price for the third tranche of SGB is fixed at Rs 4807/gm. The investment in non-physical gold, via digital or paper gold, is picking up pace. The high interest is on account of the recent firmness in the prices of Gold in the past few weeks.

The government on its part has been continuously trying to move investment in Gold from physical to digital/ paper gold to keep a check on the currency and larger fiscal deficit. Investment in SGB is a superior alternative to physical gold. Investment in SGB saves the cost of buying, storing, and selling the physical gold bar or coins.

The price for the yellow metal has been on an up move for the past 3 weeks as US Treasury yields dropped to a 4-month low due to concerns related to the virus. The next big trigger for gold prices will be the Fed meeting later this month, rising inflation in the US is a cause of concern and any change in the stance on interest rates or liquidity by the Fed will have its impact on the prices.

The latest variant of the virus has created uncertainties, rise in the number of cases. Moving forward the ability to control the virus by large countries, the pace of vaccination, global economic recovery, and the rising inflation will guide gold prices.”

Above views are of the author and not of the website kindly read disclaimer

.jpg)

Tag News

We anticipate immense potential benefits from the upcoming Sovereign Gold Bond Tranche in FY...