Perspective on Crude Oil price movement due to Russia-Ukraine conflict By Mr. Navneet Damani, Motilal Oswal Financial Services

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Below is perspective on Crude Oil price movement due to Russia-Ukraine conflict By Mr. Navneet Damani, VP – Commodities Research, Motilal Oswal Financial Services

Oil:

The spike has been driven primarily by fears of supply side disruptions as the threat of Russian invasion in Ukraine looms large following Putin’s deployment of troops. Sanctions forcing Russia to supply less crude or natural gas would have substantial implications on oil prices and the global economy. Russia accounts for one in every 10 barrels of oil consumed globally, so it is a major player when it comes to the price of oil and it's really going to hurt consumers at the petrol pumps.

India:

The rise in crude prices poses inflationary, fiscal, and external sector risks. Crude oil-related products have a direct share of over 9 per cent in the WPI basket. The rise in crude oil prices is also expected to increase the subsidy on LPG and kerosene, pushing up the subsidy bill. India is Ukraine's largest export destination in the Asia-Pacific and the fifth largest overall. India's main exports to the European country are pharmaceutical products, reactors/boiler machinery, mechanical appliances, oil seeds, fruits, coffee, tea and spices among others. Pharmaceuticals account for the majority of Indian exports to Ukraine.

Oil could go above $100 a barrel due to a combination of the Ukraine crisis, a cold winter in the US, and a lack of investment in oil and gas supplies around the world.

Above views are of the author and not of the website kindly read disclaimer

Tag News

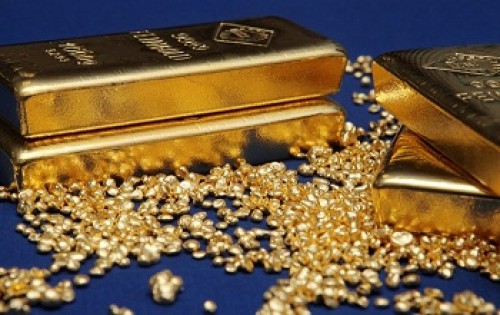

We anticipate immense potential benefits from the upcoming Sovereign Gold Bond Tranche in FY...

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">