Paytm post listing view By Mr. Santosh Meena, Swastika Investmart Ltd

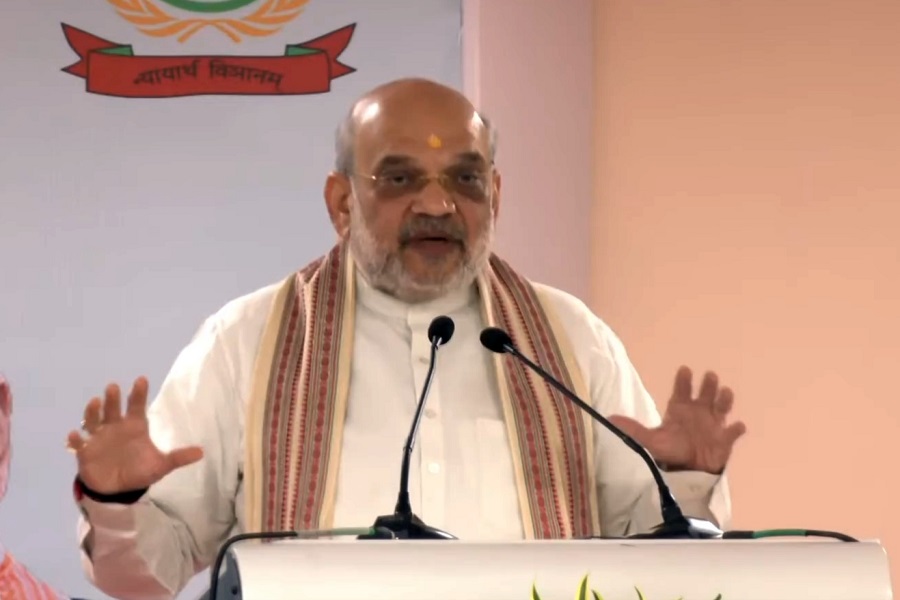

Below is quote on Paytm post listing view by Mr. Santosh Meena, Head of Research, Swastika Investmart Ltd

Paytm, The biggest IPO in India so far debuted the secondary market on a weaker note as compared to our expectations of a flat listing. The company has a huge customer base with strong brand positioning and it has an early mover advantage in digital payment services however it is still a loss-making company and very aggressively priced therefore we saw a tepid response in terms of subscriptions. It is difficult to value such kind companies for time being but by the time market will understand the way to value such kinds of businesses where the market will focus on how fast it will become profitable and how well it will use its strength to explore new businesses like Credit card and Payment banking. I would suggest only aggressive investors hold this stock for the long term amid uncertainty where I believe Bajaj Finserv is a much better option to play on Fintech businesses because Bajaj Finserv has a proven track record with great comfort of valuations compared to Paytm. Those who played for listing gain should keep a stop loss below 1720 which is 20% lower than the issue price.

Above views are of the author and not of the website kindly read disclaimer