PC shipments, chip sales growth face record slump this year

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

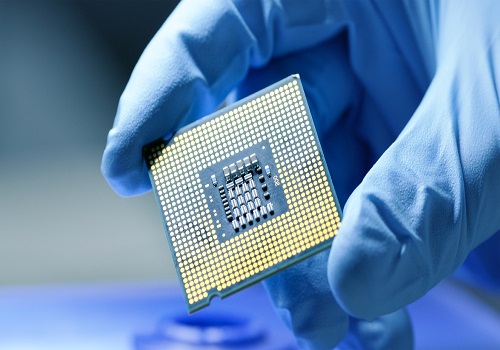

Global semiconductor revenue is projected to slow down to 7.4 per cent this year, down from 2021 growth of 26.3 per cent, while chip sales from PCs are likely to decline 5.4 per cent, according to Gartner.

PC shipments are set to decline by 13.1 per cent this year after recording growth in 2020 and 2021.

Semiconductor revenue from smartphones is on pace to slow to 3.1 per cent growth, compared to 24.5 per cent growth in 2021.

"Although chip shortages are abating, the global semiconductor market is entering a period of weakness, which will persist through 2023 when semiconductor revenue is projected to decline 2.5 per cent," said Richard Gordon, Practice VP at Gartner.

The manufacturers are already seeing weakness in semiconductor end markets, especially those exposed to consumer spending.

Rising inflation, taxes and interest rates, together with higher energy and fuel costs, are putting pressure on consumer disposable income.

"This is affecting spending on electronic products such as PCs and smartphones," Gordon added.

Overall, 2022 global semiconductor revenue has been reduced from the previous quarter's forecast by $36.7 billion, to $639.2 billion, as economic conditions are expected to worsen through the year.

Memory demand and pricing have softened, especially in consumer-related areas like PCs and smartphones, which will help lead the slowdown in growth.

From an enterprise perspective, inventories are recovering rapidly, lead times are beginning to shorten, and prices are starting to weaken.

"The semiconductor market is entering an industry down cycle, which is not new, and has happened many times before," said Gordon.

"While the consumer space will slow down, semiconductor revenue from the data centre market will remain resilient for longer (20 per cent growth in 2022) due to continued cloud infrastructure investment," he informed.

In addition, the automotive electronics segment will continue to record double-digit growth over the next three years as semiconductor content per vehicle will increase due to the transition to electric and autonomous vehicles.

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">