Opening Bell: Markets likely to get cautious start following hawkish rate pause by US Fed

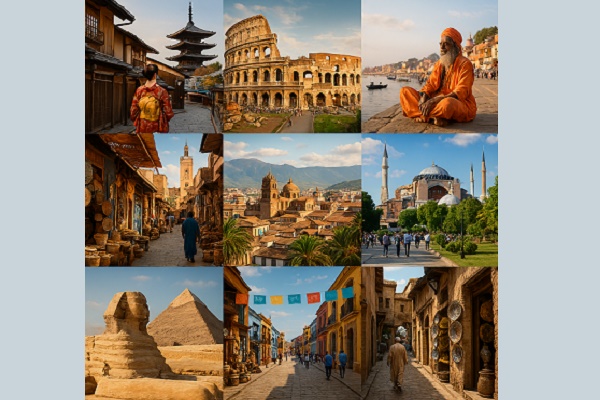

Indian markets ended higher for a third straight trading session on Wednesday led by gains in index heavyweight Reliance Industries, along with FMCG and metal stocks. Today, markets are likely to get cautious start following a hawkish rate pause by the US Fed announced overnight. There will be concerned with a private report stating that the sowing of kharif crops such as paddy, pulses and oilseeds is likely to be delayed with the sluggish progress of monsoon following a late onset over the Kerala coast on June 8. Some cautiousness will come as domestic rating agency Crisil said the growth in aggregate GST collection for states is likely to moderate to 12-14 per cent in FY24 from 20 per cent in FY23. However, foreign fund inflows likely to aid domestic sentiments. According to the provisional data available on the NSE, foreign institutional investors (FII) purchased shares worth a net Rs 1,714.72 crore on June 14. Besides, International Energy Agency (IEA) chief Fatih Birol said India will soon overtake China as the largest driver of global oil demand even as it has an opportunity to become a world leader in green hydrogen production. There will be some reaction in IT stocks as a private report reiterated its negative stance on Indian information technology (IT) services and downgraded the sector to underweight, as it believes the overall demand environment for the sector still remains weak. Among stocks, it has placed Infosys, TCS, MphasiS in its negative catalyst watch. Jewellery industry stocks will be in focus as the Gem Jewellery Export Promotion Council (GJEPC) said the overall gems and jewellery exports witnessed a decline of 10.70 per cent in May at Rs 22,693.41 crore ($2,755.90 million). There will be some reaction in auto and auto ancillary industry stocks with a private report that the Cabinet is likely to approve a Rs 25,000 crore scheme for semiconductor manufacturing in the country. Tourism industry stocks will be in limelight as India generated an income of $7,400 million through medical tourism over the last decade, and the figure is expected to rise to $43,500 million in the next 10 years.

The US markets ended mostly in green on Wednesday after the US Federal Reserve did not alter the interest rates, but signalled in new projections that the key lending rate might need to rise by as much as half of a percentage point by the end of this year. Asian markets are trading mostly higher on Thursday after China's central bank cut its key one-year interest rate to support real estate and domestic demand.

Back home, extending their winning run for the third consecutive session, Indian equity benchmarks ended marginally higher on Wednesday led by gains in index heavyweight Tata Steel, Power Grid Corporation, along with Metal and Oil & Gas stocks. After making a cautious start, markets slipped into red as traders were concerned after Moody’s sees some of its India’s large corporates with foreign currency debt facing refinancing risk in calendar year 2024 (CY24). This would be owing to a combination of higher interest risk in the international financial market and a likely deterioration in their finances. However, the domestic indices staged recovery in early noon deals, driven by encouraging WPI inflation data. India’s inflation based on wholesale price index (WPI) maintained the declining trend in the month of May 2023 at (-) 3.48% as against (-) 0.92% recorded in April 2023. Decline in the rate of inflation is primarily contributed by fall in prices of food articles, non-food articles and crude petroleum & natural gas, coal, mineral oils and electricity. Markets added gains in afternoon deals, amid foreign fund inflows. According to the provisional data available on the NSE, foreign institutional investors (FII) purchased shares worth net Rs 1,677.60 crore on June 13. Sentiments remained positive with Reserve Bank of India Governor Shaktikanta Das’ statement that India's economic growth in the past few years is mainly driven by robust domestic demand and the country will continue to remain among the fastest-growing large economies in 2023. He also said the Indian economy had made rapid gains and has gradually integrated with the global economy over the years. But, markets trimmed some gains in final minutes of trade as some concern came after a private Weather forecasting agency predicted a bleak monsoon in India over the next four weeks, raising concerns about the impact on agriculture. Finally, the BSE Sensex rose 85.35 points or 0.14% to 63,228.51 and the CNX Nifty was up by 39.75 points or 0.21% to 18,755.90.

Above views are of the author and not of the website kindly read disclaimer