On the daily chart, MCX Nickel (Apr) future has been trading below the Rising Trendline - Choice Broking

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Nickel

LME and MCX Nickel futures mainly traded sideways to bearish during the month of March, as demand has once again witnessed decline in China and other Asian countries. This has also reduced the raw material/output demand in the manufacturing sectors from Philippines and Indonesia for its electronic vehicles car manufacturing sector. Moreover, the demand from the western countries has been relatively sluggish in the past weeks with reports of rise in covid-19 cases along with rising bond yields, US dollar index and global market sell-offs. By 31st March, MCX Nickel prices declined by 14.37% closing at Rs.1205/ke.

Fundamentally for the month ahead, we are expecting LME and MCX Nickel futures to witness uptrend with reports of higher demand from the battery sector in United States. Recently, President Joe Biden's vast infrastructure plan of $2.3 trillion includes $174 billion to boost the markets for electric vehicles and billions more for renewable power - both provisions aimed at weaning the U.S. off of fossil fuels and combating climate change; which is estimated to support Global Nickel prices in the coming weeks. The plan to rebuild America's crumbling infrastructure proposes doubling federal funding for mass transit and spending $80 billion to expand and modernize passenger rail service; estimated to support global base metal prices, Although demand in Russia and European Union could weaken, however, the demand for Cobalt, Lithium and Nickel is expected to find strength in the later half of April. However, the imports of raw material Imports has become more expensive with rising dollar index. High spending on the infrastructure sector in India with recovered demand in the automobile sector for e-vehicles is forecasted to support prices from the lower levels. Though global uncertainties continue to weigh on base metal markets inthe near future, but then again, demand for Nickel is expected to rise in the longer duration.

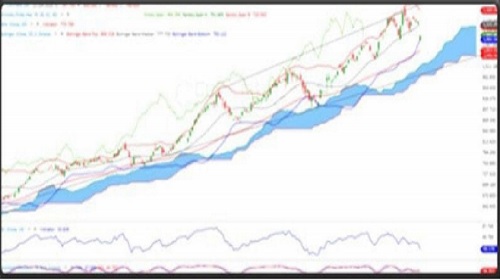

On the daily chart, MCX Nickel (Apr) future has been trading below the Rising Trendline, which indicates downward move in the counter. Moreover, the price has shifted below Ichimoku Cloud formation and 100 days Simple Moving Averages, which suggest the bearish trend for long term. In additions, amomentum indicator RS! (14) and Stochastic witnessed a negative crossover, which adds bearish sentiments in the prices for the near term. So, based on the above technical structure one can initiate a short position in MCX Nickel (Apr) future at CMP 1184 or a rise in the prices till 1188 levels can be used as a selling opportunity for the downside target of 1125. However, the bearish view will be negated if MCX Nickel (Apr) future at CMP 1184 or a rise in the prices till 1188 levels can be used as a selling opportunity for the downside target of 1125

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://choicebroking.in/disclaimer

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer