Nifty: Sustainability of 14700 crucial for uptrend to resume - ICICI Direct

Nifty: Sustainability of 14700 crucial for uptrend to resume

* The Nifty failed to sustain above 15000 and moved towards 14700 once again in the truncated last week amid global weakness. In the last couple of months, the Nifty has been largely in a broader range while stock specific movements were observed amid result season. Even midcap and small cap stocks have experienced some profit taking in the last couple of sessions and both indices lost almost 3% from highs. We believe the Nifty may continue its range bound bias with intermediate pivot levels of 14700 levels

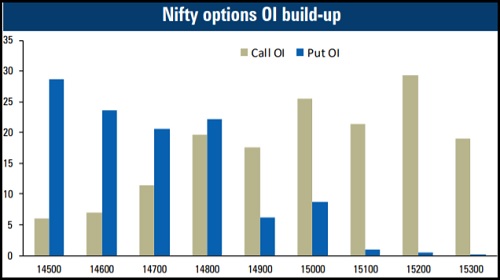

* Going ahead, sustainability of 14700 seems crucial for fresh positive bias from a trading perspective. Even from the options perspective, continued writing was experienced at ATM Call and Put strikes suggesting range bound bias to continue with significant activities seen at OTM Call strikes. Hence, sustainability above 14700 may trigger closure among Call writers, which may pull the Nifty towards higher band of the consolidation. On downsides, we expect levels near 14500 to provide support to the index

* Sectorally, while banking and technology stocks were the major draggers of the markets and ended the week near lows. Metal space also saw some cool-off after a sharp surge was seen in the last couple of months. However, heavyweights like Reliance Industries and FMCG stocks came to the rescue as the Nifty was able to close in the vicinity of 14700. We expect the banking space to take the lead for the Nifty movement towards 15000 in coming sessions

Bank Nifty: Support for index at 31000 levels…

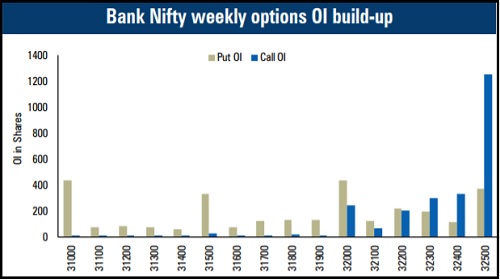

* For a fourth week in a row, the Bank Nifty traded in a range with stock specific action. Short Strangle strategies continues to make money, which is pointing towards further consolidation being possible

* Private banks like Axis Bank and Kotak Mahindra Bank are trading near their Put bases and sustainability below Put base should trigger some more selling in this banks. However, PSU banks along with midcap private banks are positive. We feel other PSU banks should provide cushion to the index

* Last week the Bank Nifty saw liquidation of positions as 9% closure was observed in open interest. Lack of formation of short positions is indicating limited downsides

* IVs remained choppy on a weekly basis due to which option premiums has declined sharply. We feel that unless we do not see any major spike in IVs, the current leg of consolidation in the Bank Nifty should continue. Major support for the index is placed at 31000 whereas on upsides, last week’s high should act as a supply zone. Hence, we feel short Strangle of 1000 points OTM strikes could be the strategy for the week

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer