New sales in May improved compared to April; sub INR 1 CR 62% of total new sales: Knight Frank India

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

New sales in May improved compared to April; sub INR 1 CR 62% of total new sales: Knight Frank India

* 29% of registrations in May 2021 were new sales during the month compared to 7% of registrations in April 2021

* 1,554 new housing units registered in May 2021 compared to 710 units registered in April 2021, but much lower compared to 6,270 units sold in May 2019

* 71% of 5,360 registrations in May 2021 were from property deals closed between December 2020 to April 2021

* Only 1.7% of new sales registered in May 2021 were by women homebuyers compared to 6.6% during April 2021

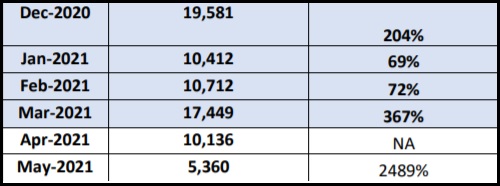

Mumbai, June 1, 2021: Knight Frank India, the leading real estate consultancy in the country, noted that Mumbai BMC region (i.e. Churchgate to Dahisar and Colaba to Mulund) recorded property registrations of 5,360 units in May 2021, registering a decline of 47% Month-on-Month (MoM) compared to April 2021 and down 15% compared to 6,270 units registered in May 2019. However, the registrations in May 2021 were up 25 times higher compared to May 2020 as the lockdown restrictions are less stringent this year. Delving deeper into the property registrations data, it was noted that only 29% of registrations in May 2021 were from new residential sales concluded in the month, while 71% of the registered properties were from sales concluded in the period December 2020 to April 2021 period that got registered in month of May. Of the total new sales in May 2021, 62% were in sub INR 1 Crores (CR) category.

The Maharashtra state government in December 2020 had given a leeway of four months to homebuyers to register a property after the payment of stamp duty in order to prevent crowding of registration offices. This ensured that homebuyers who had purchased residences and paid stamp duty on or before 31st March 2021, have maximum window of 4 months till 31st July 2021 from the respective date of payment of stamp duty for registering their apartment. Before this leeway was permitted, for over 95% of registrations in the recent years, the difference between date of payment of stamp duty and date of registration was less than 10 days and for less than 2% of the registrations, the difference was over 30 days.

Table 1: Property Registrations (2020-2021)

Despite a MoM drop of 47% in registrations in May 2021, the new units sold during the month has grown by 119% MoM from 710 units in April 2021 to 1,554 units in May 2021. This implies that in spite of the current lockdown restrictions, the market has started picking up; however, the numbers are nowhere close 6,270 units registered during May 2019. A strong demand stimulant is therefore required to further propel sales to regain pre-COVID levels.

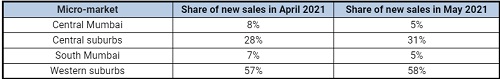

Table 2: Corresponding deal closure period for registrations during April 2021 and May 2021

Table 3: Micro-market wise break up of new apartment sales

Share of women homebuyers in new sales drops from 6.6% in April 2021 to 1.7% in May 2021

On 8th March 2021, to celebrate International Women’s Day, the Maharashtra Government announced a 1% rebate in stamp duty for women homebuyers effective from 1st April 2021. As a result of which women homebuyers constituted 6.6% of new home sales in the month of April 2021 paying a discounted stamp duty rate of 4% over their purchase. In May 2021, the share of women homebuyers across the 5,360 units registered in May 2021 dropped to 1.7%.

Table 4: Ticket size wise break up of units registered in April 2021

Upon assessment of sales and registration data since September 2020 – March 2021, it was observed that during the period of reduced stamp duty, new homes sales for that month in mid to premium categories, those costing INR 1 Cr and above, formed a significant part of the sales and registration. It could be deduced post-facto that the saving on stamp duty on higher value housing units would work out significantly in favour of the buyers saving them substantial amount in hand. However, since the withdrawal of the sop on stamp duty, the equations have tilted in favour of homes costing INR 1 CR or less, with this category taking 70% and 62% of total new sales in April 2021 and May 2021 respectively. This should be seen as a positive indication of the strength of demand from end users in this segment that continues to purchase despite no stamp duty relief. Going forward, as the vaccination programme gains momentum and normality returns, we expect sales momentum to gain pace led by demand from affordable and mid segment. Reintroduction of similar demand stimulant as reduced stamp duty may provide the right catalyst to this demand getting converted to sales.

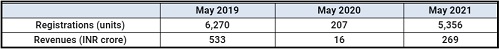

Table 5: Government collection from property registrations

The State Government’s collections from stamp duty (refer Table 5) witnessed a 50% decline in May 2021 compared to May 2019 despite overall registrations dropping only by 15%. This was because 70% of registrations in May 2021 were for apartments that were transacted in the 4 months of December 2020 to March 2021 paying stamp duty rates of 2% and 3% only but registered now.

Shishir Baijal, Chairman & Managing Director, Knight Frank India, “While the total registration in April 2021 was 10, 136, the new residences sold for that month had remained at a low 710 units. In May 2021, the number of new residential unit sales more than doubled to 1,553 showing a remarkable improvement despite the on-going lockdown. However, we are still far from pre-COVID levels of May 2019 or the levels witnessed during the 7 months of lower stamp duty window. Whilethe overall sales volumes are marred due to the lockdown conditions in Mumbai, the heartening fact is that sales in April 2021 and May 2021 have been substantially higher in the sub – 1 CR category, which is traditionally understood to be price and value sensitive. Despite withdrawal of stamp duty rebate, sales in this category have maintained pace, indicating a healthy latent demand trend. Therefore, to ensure that this demand, and indeed demands in other category, are further encouraged, the government should reconsider providing demand stimulants at the appropriate time.”

To Read Complete Report & Disclaimer Click Here

Above views are of the author and not of the website kindly read disclaimer