Natural gas futures are holding the key support of 20 day EMA - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Bullion Outlook

• Gold prices may trade under pressure amid a rise in US treasury yields. Further, improved business activity in US could support the expectations of another 25 bps rate increase at next months policy meeting

• MCX Gold is likely to slide towards the initial support at 59600. A move below would weaken the trend towards next support at 59260. The reversal in RSI could restrict its upside and bring correction in the trend. Key resistance exists around 60260 (10 DEMA)

• MCX Silver is likely to move towards the lower band of the consolidation range 73800-76000. A move below 73800 would weaken the trend towards 73000

Base Metal Outlook

• Copper is expected to remain under pressure amid expectation of a rise in key interest rate by major central banks. Further, rising doubts over the economic recovery of the world’s top consumer China would also limit its upside

• MCX Copper April future is expected to decline towards the next support near 752-750 zone as the bearish crossover of 10 and 20 day EMA would restrict it from going beyond 768-770

• MCX Aluminium is likely to dip towards 210-209 as long as it trades under 214-215. Fresh buying could be seen above 215

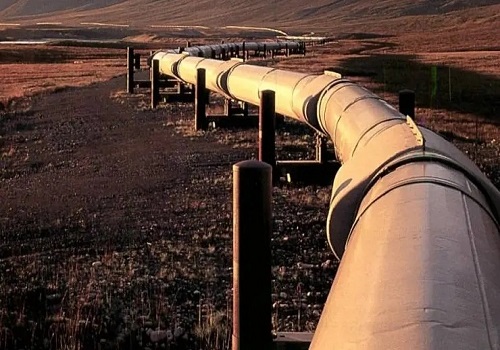

Energy Outlook

• Crude oil futures could remain under pressure amid rising prospects of higher interest rates by central banks to control the inflation. MCX Crude oil could slip further towards 6200- 6250 as long as it trades below the 10 day EMA of 6530. The fall in RSI below the neutral zone 50 would also limit the upside in oil price

• Natural gas futures are holding the key support of 20 day EMA at 178 since last couple of days. Hence, as long as 178 holds, the price is expected to move higher towards 190. The expectation of cool weather in most states in the US would be the key supporting factor to the price

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631

Above views are of the author and not of the website kindly read disclaimer

.jpg)