NCDEX Turmeric Future price has mainly traded sideways to bullish during the May month - Choice Broking

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

TURMERIC

NCDEX Turmeric Future price has mainly traded sideways to bullish during the May month closing at Rs.7960/quintal on 27th May, higher by 1.63% compared to Rs. 8090/quintal as on 31st March. Steady buying in the domestic market with increasing curfew and lower arrivals brought steady trend in prices. However, future prices have continuously sustained the levels of Rs.7800-8000 which indicates that the traders have bought the lower levels amid the ongoing pandemic with higher pharmacy demand. After the mini-super cycle in the agriculture commodities in the March month, turmeric prices have slowed down with other agriculture commodities.

Fundamentally for the month ahead, we are estimating NCDEX Turmeric futures to trade bullish, with the people of India giving more importance to health and safety amid the on-going pandemic. Expected lower production current year supported the prices in the spot market from lower levels. For the year 2021-22 marketing period, we are expecting 62000 MT (Metric tonnes) ending stocks (with increasing exports and domestic consumption), which is lower than 98000 MT from last year. The domestic APMC markets continue to remain shut, however, vaccination process is picking up pace which is expected reopen the APMC markets by coming weeks. Exports from India is expected to further rise with higher pharmacy demand and expectancy of greater demand in the middle east, European Union and United States. Unlocking process in the European Union with resuming restaurants and retail activities is expected to support NCDEX turmeric futures in the coming month.

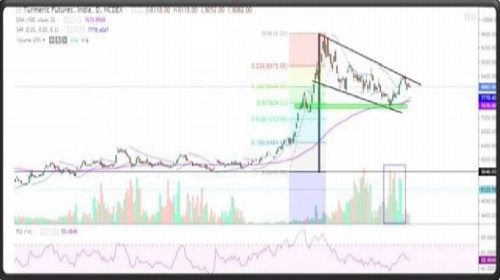

On the daily chart, NCDEX Turmeric (July) future has formed bullish continuation pattern; Flag & Poll formation from last couple of days which supports the upward trend. In addition, the price is trading above 100 Exponential Moving Averages & the trend indicator Parabolic SAR is also supportive in the long term. Moreover, the price has also taken support of 50% Fibonacci Retracement level with large volume; confirming bullish momentum in the near future. Furthermore, the RSI indicator has sustained above 50 which indicate bullish strength in the near term. Hence, based on above technical structure one can initiate a long position in NCDEX Turmeric (July) future at CMP 8080 or a fall in the price till 7920 levels, that can be used as buying opportunity for the upside target of 9050. However, the bullish view will be negated if NCDEX Turmeric (July) future close below the support level of 7400.

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://choicebroking.in/disclaimer

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer