NCDEX Turmeric Future price had initially traded bullish and later witnessed correction during the March month - Choice Broking

Turmeric

NCDEX Turmeric Future price had initially traded bullish and later witnessed correction during the March month so far closing at Rs.8268/quintal on 25th March, lower by 0.57% compared to Rs.8302/quintal as on 26th February. Improved buying in the domestic market with easing lockdown situation and higher exports from India supported prices. However, higher prices in Mid-March led to releasing the old stocks by farmers in the domestic market. Moreover, year end account statement in various APMC Mandis in southern peninsula led to easing of buying in the Indian market. Local trader are looking for turmeric spot and future prices to breach Rs.10000/quintal level, as it had breached during the period December 2016,

Fundamentally for the month ahead, we are estimating NCDEX Turmeric futures to trade bullish, with the people of India giving more importance to health and safety amid the on-going pandemic. Moreover, as the recent developments in Maharashtra (Marathwada regions) and Telangana have indicated that the crop conditions/ yield has been reported to be lower by 5-10% compared to the previous year. Reports of poor quality crop during the coming harvesting season has also supported prices. Reports of Crap damage in state of Tamil Nadu after the winter rainfall has lifted the spot prices of Salem and Erode above Rs.8000/quintal. So far, the amount of loss in the said state is still not confirmed and the actual damage may be even greater. Moreover, this year's all India production could also face a decline by 8-10% to 8.6-8.8 lakh tonnes as compared to the previous year's 9.5-9.6 lakh tonnes. However, extreme bullishness in prices can be capped as farmers continue to release stocks from the higher levels; especially stocks from the peak lockdown situation (April-May 2020), where the domestic demand and exports had taken a big blow from the covid-19 pandemic and lockdown. Exports from India is expected to further rise with higher pharmacy demand and expectancy of greater demand in the middle east during the Ramadan period for the April month,

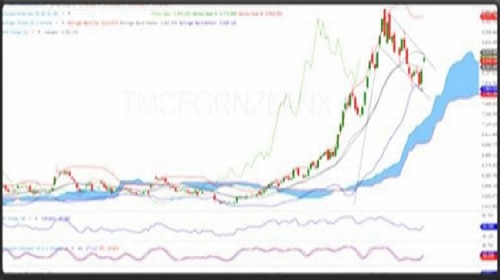

On the daily chart, NCDEX TMC (Apr) future has been forming Bullish Flag Pattern, which is a continuation pattern and indicates a buying strength for the near term. Moreover, the price has shown good bounce back after taking a support at lower Bollinger Band formation. Furthermore, the counter has also traded above Ichimoku Cloud formation, which supports the bullish trend for the long term. A momentum indicator RS! (14) and Stochastic witnessed a positive crossover on the daily chart, which suggests a bullish momentum for the upcoming sessions. So, based on the above technical structure one can initiate a long position in NCDEX Turmeric (Apr) future at CMP 8500 or a fall in the prices till 8100 levels can be used as a buying opportunity for the upside target of 9700. However, the bullish BT view will be negated if NCDEX Turmeric (Apr) closes below the support of 7800

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://choicebroking.in/disclaimer

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer