NCDEX Coriander Future price has traded sideways during the month - Choice Broking

CORIANDER SEED

NCDEX Coriander Future price has traded sideways during the month of April owing to steady buying and selling in the domestic market. Moreover, higher demand for Coriander seed in the pharmacy sector has driven in the prices to yearly high levels. Though the sowing acreage of Coriander seed had nearly doubled in the state of Gujarat, which happens to be the third largest producer in India, however, crop damage in Rajasthan and Madhya Pradesh. By 15th April, NCDEX Coriander Future price closed at Rs.7158/quintal, lower by 0.42% compared Rs.7188/quintal reported on 31st March.

Fundamentally for the month ahead, we are expecting NCDEX Coriander futures to witness uptrend as the export demand from India is expected to remain higher and the peak season for the same is likely to be witnessed during the current month of April. Moreover, the current supplies in the domestic market is relatively lower due to lower stocks from farmers during the last year which is estimated to support spot and future prices as well. Since, India is witnessing a similar lockdown worries like last year, panic buying in the domestic market is expected to be reported in Rajasthan and Madhya Pradesh. Demand for special green coriander seeds from India is expected to rise with higher demand in the pharmacy sector. Buyers are likely to be active further from the current level to go for active buying as ending stocks slowly come down. Increasing supply puts a cap on prices from higher levels, however buyers likely to become active in the spot market from lower levels in the coming days. New crop arrivals started with higher moisture content in MP, Gujarat and Rajasthan major mandi. The said fundamentals is expected to remain bullish majorly till Mid-May as later May month onwards, prices could possibly react based on monsoon forecasts.

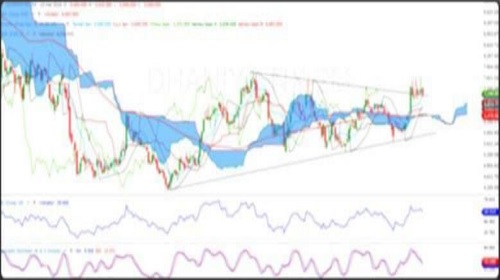

On a weekly time frame, NCDEX Dhaniya (May) future has given a breakout of Symmetrical Triangle pattern, which indicates a bullish set-up in the counter. Moreover, the price has shifted above Ichimoku Cloud formation & 100 weeks Simple Moving Averages, which suggests bullish strength for the long term. Furthermore, amomentum indicator RSI (14) traded at 60 levels with a rounding formation, however Stochastic is showing negative crossover on a weekly chart, which point-out some weakness for the near term. So, based on the above technical structure one can initiate a long position in NCDEX Dhaniya (May) future at CMP 7170 or a fall in the prices till 7140 levels can be used as a buying opportunity for the upside target of 7900. However, the bullish view will be negated if NCDEX Dhaniya (May) colses below the sopport of 6700.

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://choicebroking.in/disclaimer

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer