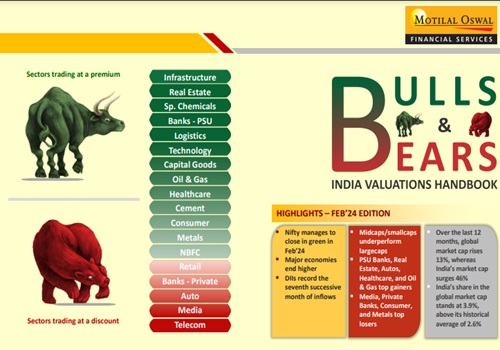

NBFC Sector Update : Disbursements continue to remain healthy By Motilal Oswal Financial Services

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Disbursements continue to remain healthy…

…asset quality stable

Please find below the key takeaways from MMFS’ Nov’22 Business Update:???????

* MMFS’ reported Nov’22 disbursements of INR45b rose 75% YoY; the management attributed this strong momentum to macro tailwinds. However, disbursements declined ~14% MoM (INR52.5b in Oct’22).

* YTD-Nov’22 disbursements grew ~99% YoY to INR310.5b. New business volumes have remained strong, which are feeding the healthy disbursements growth for all Vehicle Financiers. As of Nov’22, gross business assets grew ~3.4% over Sep’22 and ~17.5% YTD to ~INR763b.

* Collection efficiency (CE) was at 96% in Nov’22 (v/s 94% in Nov’21 and 91% in Oct’22).

* Management estimated Stage 2 assets to be below 9% as of Nov’22, (declined v/s Oct’22), while Stage 3 was stable MoM at lower than 7%.

* Management expects the GNPA (according to IRAC norms) to be higher than Stage 3 assets by ~INR12b as of Nov’22. However, it remains confident that no additional provisions would be required over and above the ECL provisions for FY23E.

* We expect the company to deliver an RoE in the range of ~11% over the medium term. We find its current valuation of 1.6x FY24E P/BV reasonable from a risk-reward perspective and maintain our BUY rating on the stock.

To Read Complete Report & Disclaimer Click Here

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354

Above views are of the author and not of the website kindly read disclaimer

Tag News

Buy Dalmia Bharat Ltd For Target Rs.2,400 - Motilal Oswal Financial Services Ltd