Mumbai sees blockbuster property registrations in the final days of lower stamp duty window By Shishir Baijal, Knight Frank India

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Below are Views On Mumbai sees blockbuster property registrations in the final days of lower stamp duty window By Shishir Baijal, Chairman & Managing Director, Knight Frank India

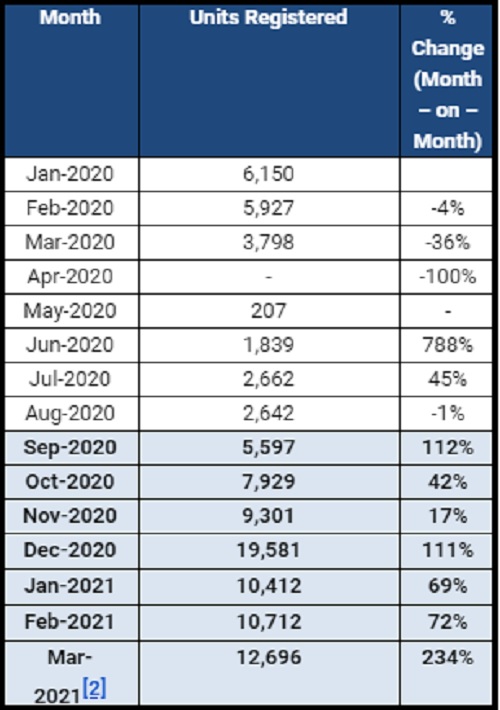

- Daily rate of new registrations in March 2021 grows 332% YoY, recording the highest YoY growth in this stamp duty cut regime

- 12,696 units registered in the month of March 20211; second highest in last 7 months

- Apartments worth INR 38,343 CR have been sold till date in 2021

- Total expected registrations to be upwards of 17,800 units for March 2021

- Registrations in the first 3 months of 20211 have almost reached the halfway mark of full year 2019 and 2020

Mumbai, March 25, 2021: Knight Frank India, the leading real estate consultancy in the country, today noted that Mumbai recorded a historic surge in property registrations driven by home sales in the last month of the lower stamp duty window that began on 1st September 2020 and closes on 31st March 2021. The euphoria amongst homebuyers has grown stronger despite the 1 percentage point or 100 bps increase in stamp duty rates effective from 1st January 2021.

From 1st March 2021 to 24th March 2021 Mumbai recorded property registration of 12,696 units at a daily rate of 529 units which is nearly 4.3 times higher than the daily rate of registration recorded at 123 units in March 2020. The sales particularly peaked in the last few days of the month with daily rate of new registrations increasing to 707 units between March 15 – 24, 2020. At the current pace, the month of March 2021 can witness sales upwards of 17,000 units. In December 2020 - the closing month for the first phase of reduced stamp duty, there was a stupendous increase in registrations in the last few days of the month as homebuyers rushed to make the most of the lower stamp duty window of 2%. From December 1, 2020 to December 25, 2020 the daily average of number of units getting registered in the month of December 2020 was at 585 units. This daily average of registrations nearly doubled at 1019 units in the last week between December 27 – 30, 2020. We expect similar trend to play out in March 2021 as well.

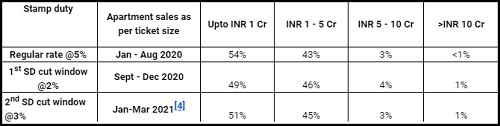

From 1st September 2020 till date1, the total revenue from apartments sales realized by the city exchequer has been over INR 2,578 crores. When compared to the period before the stamp duty cut, i.e January 2020 to August 2020 the Government had collected INR 1,756 Crores. This can be seen as a clear indication of the strong impact the stamp duty registrations have had on the revenues.

The reduction in stamp duty has created beeline for purchase of homes outside registration offices with Mumbai witnessing historically strong sales. Homes sales have continuously risen month on month in each window. Between the period from September 01 2020 – March 24 2021, Mumbai recorded registration of 75,688 units with numbers growing incrementally month on month in both windows.

HOME SALES REGISTRATIONS (2020 - 2021)

Source: Maharashtra Govt- Dept. of Registrations and Stamps (IGR); Knight Frank India Research

The sales in March 20212 grew 234% YoY over the same month last year, registering the highest YoY growth in the months after the stamp duty cut. While March 2020 noted registrations of 3,798 units, March 20212 saw 12,696 units being registered.

As a direct result of the pandemic experience, home buying has improved. 2019 saw total sales of 67,863 units, whereas registrations in 2020 have come comfortably close to last year’s level at 65,272 units. Registrations in the first 3 months of 20212 have almost reached the halfway mark of full year 2019 and 2020 at 33,280 units.

Source: Maharashtra Govt- Dept. of Registrations and Stamps (IGR); Knight Frank India Research

The value of apartments sold in Jan-March 20212 period added to INR 39,880 crore. Since the reduction of stamp duty rates from September 2021, apartments worth INR 1,08,967 crore (1.07 lakh crore) have been sold. Total value of all apartments sold in full year 2020 was estimated to be around INR 1,00,245 crore or (INR 1 lakh crore) surpassing the 2019 mark of INR 90,769 crores.

The implied flat value (average price of apartment) sold has come down in the months following 1 percentage point increase in stamp duty rate, as most of the high-ticket size apartment purchase happened before the closure of the lowest 2% stamp duty window, which ended in December 2020. The implied flat value had reached INR 1.72 crore (or INR 17.2 million) in December 2020 and dropped to below INR 1 crore during January 2021 and gradually rose to INR 1.41 crore in March 2021[3] as the momentum extended to the mid segment also during this window.

Shishir Baijal, Chairman & Managing Director, Knight Frank India said, “The reduction in stamp duty rate has helped mitigate the pain in the long-beleaguered real estate sector of Mumbai. As expected, with the revival of the economy, the sales momentum grew stronger in Q1 2021 and the euphoria amongst homebuyers continued despite the 100-bps increase in stamp duty rates. A combination of lowest home loan rates, reduced house prices along with rebates and payment flexibility offered by developers, as well as increased household saving rates, have provided the right growth environment for the residential segment to grow.”

Shishir further added, “After several years of anguish, the real estate sector in Mumbai is making an attempt to stand on its feet. However, the rising number of cases in the country and the resultant lockdowns in some cities, is threatening to jeopardise this arduous recovery path charted by the sector. It would be immensely helpful if the Government extends the window of stamp duty reduction by few more months till the sector can find its feet and start sprinting again.”

Above views are of the author and not of the website kindly read disclaimer

Tag News

We anticipate immense potential benefits from the upcoming Sovereign Gold Bond Tranche in FY...