Monthly Market Outlook By ICICI Direct

Earnings trajectory unchanged, trimming multiples amid rising interest rates, positive stance retained

Global equity markets witnessed a sharp correction since our last report with Indian markets being no exception. It was primarily driven by the elongated geopolitical conflict, consequent rise in key commodity prices namely crude, metals, agri commodities and resultant central banks action to tame unprecedented inflation. Corporate earnings, a true barometer of economic health, on the other hand, have been quite resilient with Nifty EPS for Q4FY22 coming in on broadly expected lines at | 207/share, up 10% QoQ and YoY. The margin pressure for the manufacturing businesses as well as wage inflation for IT domain was successfully made good by the earnings outperformance in the BFSI domain on the back of better-than-expected credit growth and improving asset quality. The management commentary across businesses was positive on the demand outlook amid a pick-up in economic activity, aggressive infrastructure spend outlay by the central government, revival in private capex cycle but was wary of further input costs inflation resulting in broader price hikes and a tad soft margin trajectory. We believe the present market volatility offers an attractive opportunity to build a long term portfolio of quality companies, which have lean balance sheets, are capital efficient and have growth longevity.

Highlights

* Global and domestic markets undergo a sharp correction in the recent past amid higher than anticipated interest rate hike trajectory. RBI increases the repo rate by 40 bps, out of turn in May 2022, ahead of the scheduled meet

* On the economic parameters front, data points are encouraging in terms of GST collection, vehicle registrations as well as e-way bill generation

* Monthly GST collection has consistently been over | 1.3 lakh crore since October 2021 with April 2022 reading at a high of | 1.7 lakh crore

* Daily Vahan registrations have averaged at ~90% of pre-Covid levels consistently over past three months. On the CV space, cyclical recovery is reaffirmed with Domestic CV sales up 26% YoY in FY22 at 7.2 lakh units

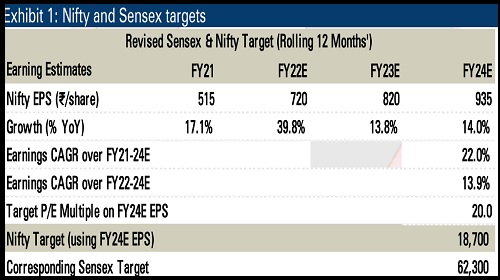

* Incorporating the revised estimates, rolling over our valuation to FY24E and at the same time trimming our valuation multiples, we now value Nifty at 18,700 i.e. 20x PE on FY24E EPS of | 935/share. Corresponding target for Sensex is at 62,300. These are our rolling 12 months’ index target

* As structural bets, we like capex linked capital goods, commercial vehicle space and PLI oriented domestic manufacturing play

Sectoral Earnings

Going forward, single digit downgrades were visible across most sectors but it was made good by the upgrades in the index heavy BFSI domain.

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Above views are of the author and not of the website kindly read disclaimer

Tag News

More News

.jpg)

Stock Option OI Report 22nd December 2025 by Nirmal Bang Ltd

.jpg)