Midday Review: Sensex, Nifty off day`s low in early afternoon session

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

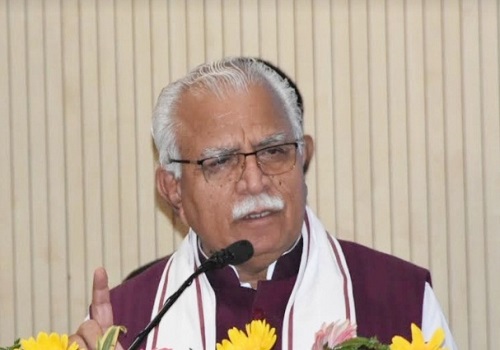

Indian equity benchmarks remained lower but managed to trim some of their losses in early afternoon deals to come off day’s low points, on the back of positive cues from other Asian markets. Losses got cut, as traders took some support with Union Minister of Agriculture and Farmers Welfare, Narendra Singh Tomar’s statement that India is moving towards positive changes. He also said ‘the current scenario of India has changed, within the country and at the world level. Today we have the capability of making our nation strong in every respect.’ Adding some relief among traders, a private report stated that the valuations of Indian companies have grown at a faster pace than their foreign parent.

On the global front, Asian markets were trading mostly in green, as the services sector in Japan continued to expand in October, and at a faster pace, the latest survey from Jibun Bank revealed with a services PMI score of 53.2. That's up from 52.2 in September, and it moves further above the boom-or-bust line of 50 that separates expansion from contraction.

The BSE Sensex is currently trading at 60759.07, down by 77.34 points or 0.13% after trading in a range of 60666.01 and 60989.41. There were 11 stocks advancing against 19 stocks declining on the index.

The broader indices were trading mixed; the BSE Mid cap index was down by 0.09%, while Small cap index up by 0.38%.

The top gaining sectoral indices on the BSE were Metal up by 1.62%, Industrials up by 0.36%, Capital Goods up by 0.33%, Energy up by 0.22% and Realty up by 0.17%, while IT down by 0.87%, TECK down by 0.85%, Healthcare down by 0.64%, Utilities down by 0.49% and Consumer Durables down by 0.36% were the top losing indices on BSE.

The top gainers on the Sensex were Bajaj Finserv up by 3.41%, Ultratech Cement up by 3.35%, Reliance Industries up by 1.10%, Tata Steel up by 0.88% and Asian Paints up by 0.84%. On the flip side, Infosys down by 1.51%, Dr. Reddy's Lab down by 1.27%, Power Grid down by 1.07%, Sun Pharma down by 1.06% and HDFC Bank down by 0.97% were the top losers.

Meanwhile, terming agriculture and the agricultural economy as the strength of India, Union Minister of Agriculture and Farmers Welfare, Narendra Singh Tomar has said that India is moving towards positive changes. He also said ‘the current scenario of India has changed, within the country and at the world level. Today we have the capability of making our nation strong in every respect.’

Tomar noted that the big economies of the world have not yet recovered from the impact of Covid, but still Indian economy is strong. The reason for this is the timely steps taken under the leadership of Prime Minister Narendra Modi. The central government made many efforts one after the other for other industries including MSMEs and also for agriculture and the common poor man. Work was done to make vaccines on time, injecting the economy with schemes like PLI.

Union Minister of Agriculture and Farmers Welfare further said that agriculture should be profitable, production-productivity should increase, chemical-fertilizer should be used properly, awareness about soil health should increase, all this is necessary for the holistic development of agriculture.

The CNX Nifty is currently trading at 18050.05, down by 2.65 points or 0.01% after trading in a range of 18017.15 and 18108.00. There were 24 stocks advancing against 26 stocks declining on the index.

The top gainers on Nifty were Bajaj Finserv up by 3.54%, Ultratech Cement up by 3.36%, Adani Enterprises up by 2.16%, Hindalco up by 1.99% and JSW Steel up by 1.82%. On the flip side, Hero MotoCorp down by 2.62%, BPCL down by 1.75%, Infosys down by 1.55%, HDFC Life Insurance down by 1.40% and Dr. Reddy's Lab down by 1.24% were the top losers.

Asian markets were trading mostly in green; Hang Seng increased 966.20 points or 6.3% to 16,305.69, Taiwan Weighted strengthened 40.11 points or 0.31% to 13,026.71, KOSPI rose 19.26 points or 0.83% to 2,348.43, Shanghai Composite gained 72.79 points or 2.43% to 3,070.60 and Straits Times advanced 25.19 points or 0.81% to 3,127.70. On the flip side, Nikkei 225 slipped 463.65 points or 1.68% to 27,199.74 and Jakarta Composite lost 53.63 points or 0.76% to 6,980.94.

Above views are of the author and not of the website kindly read disclaimer

Tag News

Weekly Market Analysis : Markets strengthened recovery and gained nearly 2% in the passing w...